Systematic fairness plan empowers you to construct wealth persistently and steadily. By automating your investments, you may keep away from the emotional rollercoaster of market fluctuations and keep disciplined in your path to monetary success. This technique gives a structured method to investing in equities, permitting you to attain your long-term monetary objectives. This plan is a strong device, particularly for these aiming for a safe monetary future.

This structured method, in contrast to different funding methods, presents the benefit of constant contributions, no matter market circumstances. It additionally helps handle threat by way of diversification and common rebalancing. Totally different systematic fairness plan varieties supply various funding frequencies and account choices, tailoring the technique to your particular wants and objectives. Understanding the benefits, drawbacks, and dangers related to every kind is essential to creating knowledgeable choices.

Defining Systematic Fairness Plans

Systematic fairness plans are a structured method to investing within the inventory market, automating the method of shopping for and holding fairness investments over time. They supply a disciplined funding technique, serving to traders keep away from emotional decision-making and construct long-term wealth by way of common contributions. This methodical method could be particularly useful for many who lack the time or experience to handle their investments every day.This method presents a predictable and constant technique to take part out there’s development, decreasing the volatility related to making sporadic, emotional choices.

By persistently contributing, traders can leverage the facility of compounding and probably profit from the long-term development of the market. This method promotes a extra disciplined and constant funding technique, probably bettering long-term returns and decreasing the emotional stress related to managing investments.

Varieties of Systematic Fairness Plans

Numerous forms of systematic fairness plans exist, catering to completely different investor wants and targets. These plans differ of their funding frequency, account varieties, and related charges. Understanding the out there choices is essential for traders to decide on a plan that aligns with their monetary objectives and threat tolerance.

Funding Frequency

The frequency of contributions is a key attribute of systematic fairness plans. Traders can select from varied choices, together with month-to-month, quarterly, and even annual contributions. The frequency of contributions influences the general funding price and potential return.

Account Varieties

Systematic fairness plans could be carried out inside varied account varieties. Brokerage accounts are generally used for actively managed funding methods. Retirement accounts, equivalent to IRAs or 401(ok)s, are sometimes employed for long-term wealth accumulation. Selecting the best account kind is crucial for tax benefits and long-term development.

You can also perceive helpful information by exploring hampden seating plan.

Charges and Bills

Charges related to systematic fairness plans can range considerably. Charges are sometimes categorized as both mounted or variable. Mounted charges are sometimes easy, whereas variable charges can fluctuate based mostly on funding efficiency or different elements. Understanding the price construction is crucial to evaluating the general price of the plan.

Key Options and Traits

A typical systematic fairness plan includes repeatedly scheduled investments into a selected fairness portfolio. These plans typically function predefined funding quantities and frequencies, permitting for constant contributions over time. Key options additionally embrace automated transactions, decreasing the necessity for handbook intervention, and sometimes present a transparent and simple funding technique.

Discover the completely different benefits of east stock that may change the way in which you view this concern.

Examples of Systematic Fairness Plan Buildings

Totally different systematic fairness plans can have various constructions. For example, a month-to-month contribution plan might contain allocating a set quantity to a diversified portfolio of shares each month. Alternatively, a quarterly contribution plan may allocate a hard and fast sum to a portfolio emphasizing development shares. The particular allocation of property inside the portfolio will range based mostly on the investor’s objectives and threat tolerance.

Comparability of Systematic Fairness Plan Varieties

| Plan Kind | Funding Frequency | Account Kind | Charges |

|---|---|---|---|

| Month-to-month Contribution Plan | Month-to-month | Brokerage Account | Variable |

| Quarterly Contribution Plan | Quarterly | Retirement Account | Mounted |

| Annual Contribution Plan | Yearly | Brokerage Account or Retirement Account | Variable |

Advantages and Benefits

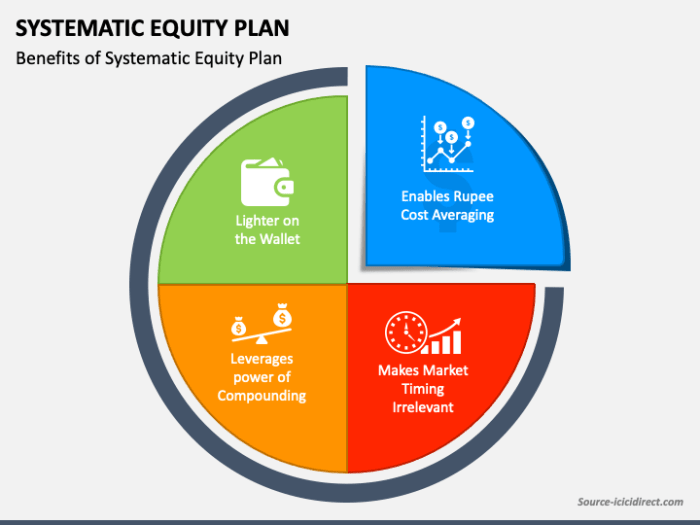

Systematic fairness plans supply a structured method to investing, mitigating emotional decision-making and fostering long-term development. This disciplined technique, in comparison with different approaches, gives a clearer path to reaching monetary objectives, particularly for these new to investing or missing constant funding self-discipline. The constant nature of those plans helps to construct wealth over time by way of the facility of compounding.Understanding the potential benefits of systematic fairness plans is essential for knowledgeable funding choices.

By automating investments, traders can keep away from impulsive reactions to market fluctuations and keep dedicated to their monetary targets. This consistency fosters a long-term perspective, permitting traders to profit from the potential for market development over prolonged intervals.

Potential Advantages of Systematic Fairness Plans

Constant contributions are a key benefit of systematic fairness plans. This regularity in funding helps to common out market volatility and easy out the experience for traders. By investing a set quantity at common intervals, traders can keep away from making emotional choices based mostly on short-term market swings.

Benefits of a Systematic Method

A scientific method to fairness investments promotes disciplined saving and investing habits. This self-discipline, coupled with the potential for long-term market development, can result in vital wealth accumulation. The structured method helps traders keep away from emotional reactions to market downturns, which regularly result in poor funding selections. The consistency in contributions additionally helps to scale back the impression of market fluctuations.

Benefits In comparison with Different Funding Methods

Systematic fairness plans typically outperform different methods, notably when contemplating the impression of compounding. They supply a disciplined and constant method to investing, which is crucial for long-term success. In comparison with reactive, opportunistic methods, systematic fairness plans permit for a extra targeted and managed method to portfolio administration. These methods supply a technique to mitigate the dangers inherent in reactive investing.

End your analysis with data from quick flash.

Comparability of Totally different Systematic Fairness Plan Varieties

Totally different systematic fairness plan varieties supply various ranges of flexibility and management. Understanding these variations is essential for choosing a plan that aligns with particular person funding objectives and threat tolerance. The benefits and downsides of every kind must be fastidiously evaluated to make sure an acceptable plan for private circumstances.

Desk of Advantages and Drawbacks of Totally different Systematic Fairness Plan Varieties

| Plan Kind | Profit 1 | Profit 2 | Downside 1 |

|---|---|---|---|

| Greenback-Price Averaging (DCA) | Reduces threat of market timing | Constant contributions | Doubtlessly decrease returns throughout vital market development intervals |

| Index Monitoring | Passive investing | Low expense ratios | Could not supply greater returns than actively managed funds |

| Development-Oriented Plans | Potential for greater returns | Publicity to greater threat | Sensitivity to market fluctuations |

Implementation and Administration

A scientific fairness plan is not nearly selecting shares; it is about constructing a sustainable funding technique. Profitable implementation hinges on cautious planning, constant execution, and steady monitoring. This method ensures that your funding objectives stay aligned along with your monetary circumstances and threat tolerance over time. The secret’s to ascertain a strong framework that adapts to altering market circumstances.Efficient administration of a scientific fairness plan includes extra than simply setting it and forgetting it.

Common assessment and rebalancing are essential for sustaining the plan’s effectiveness and guaranteeing it continues to fulfill your evolving wants. By proactively adjusting the plan, you may keep on monitor to attain your long-term monetary targets.

Setting Up a Systematic Fairness Plan

Establishing a scientific fairness plan includes a number of key steps. These steps are essential to make sure that your plan is well-defined and tailor-made to your particular person circumstances. A structured method fosters a better probability of success.

- Outline Funding Targets: Clearly articulate your monetary targets. Are you saving for retirement, a down cost on a home, or a toddler’s training? Quantifiable objectives present route and motivation, guaranteeing your plan stays related to your long-term aspirations.

- Decide Threat Tolerance: Assess your consolation degree with potential market fluctuations. The next threat tolerance permits for a bigger allocation to equities, whereas a decrease tolerance necessitates a extra conservative method. This step ensures that the chosen investments align along with your private threat profile.

- Select a Plan Kind: Choose the systematic fairness plan that most closely fits your wants and preferences. Totally different plans supply various levels of flexibility and management. The choice course of ought to take into account your consolation degree with managing the plan independently versus using skilled steerage.

- Choose Investments: Rigorously analysis and choose investments that align along with your funding objectives and threat tolerance. Take into account elements like historic efficiency, expense ratios, and diversification. Thorough analysis and evaluation are crucial for choosing applicable investments.

- Monitor and Modify: Recurrently monitor the efficiency of your investments and make needed changes to take care of your required asset allocation. Market circumstances change, and your private circumstances could evolve, so the plan should adapt.

Managing a Systematic Fairness Plan Successfully

Efficient administration of a scientific fairness plan requires ongoing monitoring and changes. This proactive method ensures the plan stays aligned along with your monetary objectives and threat tolerance.

- Common Evaluate: Evaluate your plan periodically, at the least quarterly, to evaluate its efficiency in opposition to your targets. This permits for well timed changes and retains the plan on monitor.

- Rebalancing: Periodically rebalance your portfolio to take care of the specified asset allocation. Market fluctuations may cause deviations out of your goal allocation, so rebalancing ensures that your portfolio stays aligned along with your threat tolerance and funding targets.

- Skilled Steerage: Take into account searching for skilled recommendation from a professional monetary advisor. An advisor can supply personalised steerage and help in navigating the complexities of systematic fairness plans.

Monitoring and Adjusting the Plan

Monitoring your systematic fairness plan is essential for adapting to market shifts and sustaining your required funding technique. Staying knowledgeable and adaptable is crucial for long-term success.

You can also examine extra completely about resilient lady deck plan to boost your consciousness within the area of resilient girl deck plan.

- Monitor Efficiency: Use funding monitoring instruments to watch the efficiency of your investments and evaluate them in opposition to benchmarks. Monitoring efficiency helps to determine potential points or alternatives.

- Consider Market Circumstances: Keep knowledgeable about market traits and financial circumstances to grasp how they could have an effect on your investments. Adapting to market shifts is essential for sustaining a sustainable funding technique.

- Modify Allocation (if wanted): In case your portfolio deviates considerably out of your goal asset allocation, take into account making changes to realign it along with your threat tolerance and funding objectives. Flexibility and adaptableness are key to reaching your long-term monetary targets.

Significance of Common Evaluate and Rebalancing

Common assessment and rebalancing are crucial elements of efficient systematic fairness plan administration. These steps guarantee your investments stay aligned along with your monetary objectives and threat tolerance. These actions aren’t elective, however relatively important to sustaining long-term monetary well being.

- Sustaining Desired Asset Allocation: Rebalancing ensures your portfolio stays constant along with your desired asset allocation, serving to you to remain on monitor in direction of your monetary objectives.

- Adjusting to Market Adjustments: Common evaluations permit for changes to your plan in response to market fluctuations, guaranteeing your technique stays related and efficient.

- Maximizing Returns: By proactively adjusting your plan, you may probably maximize returns whereas minimizing threat.

Step-by-Step Information for Implementing a Systematic Fairness Plan

Implementing a scientific fairness plan is a step-by-step course of. This information gives a transparent roadmap for reaching your funding targets. Following these steps will improve your probabilities of success.

- Step 1: Outline Funding TargetsClearly articulate your monetary aspirations and the timeline for reaching them. Particular objectives present route and motivation.

- Step 2: Decide Threat ToleranceConsider your consolation degree with potential market fluctuations. This evaluation guides your funding selections.

- Step 3: Select a Plan KindChoose the plan that finest aligns along with your threat tolerance, funding timeframe, and private preferences. This step includes contemplating the out there choices and choosing the right match.

- Step 4: Choose InvestmentsAnalysis and select investments that match your objectives and threat tolerance. Thorough analysis is essential for choosing applicable property.

- Step 5: Monitor and ModifyConstantly monitor your plan’s efficiency and make changes as wanted. Proactive monitoring and adaptation are important for long-term success.

Illustrative Examples: Systematic Fairness Plan

Systematic fairness plans supply a structured method to investing, aligning monetary self-discipline with long-term objectives. Understanding how these plans work in observe, and the way they are often tailor-made to particular person circumstances, is vital to maximizing their potential. This part gives real-world examples as an instance the effectiveness and flexibility of systematic fairness plans.

Retirement Financial savings with a Systematic Plan

A 35-year-old, named Sarah, desires to retire comfortably at She at present earns $80,000 per yr and has $20,000 in financial savings. She estimates her retirement wants at $4 million. Her funding technique is to take a position 15% of her month-to-month revenue in a diversified fairness portfolio, with a give attention to development shares. The desk under illustrates a pattern of Sarah’s plan:

| Yr | Age | Month-to-month Funding | Annual Funding | Estimated Portfolio Worth (Finish of Yr) |

|---|---|---|---|---|

| 1 | 35 | $950 | $11,400 | $11,800 |

| 5 | 40 | $950 | $11,400 | $65,000 |

| 10 | 45 | $950 | $11,400 | $200,000 |

| 15 | 50 | $950 | $11,400 | $550,000 |

| 20 | 55 | $950 | $11,400 | $1,500,000 |

| 25 | 60 | $950 | $11,400 | $4,000,000 |

This instance demonstrates how constant contributions, coupled with the potential for market development, can considerably enhance financial savings over time. It is vital to notice that these figures are estimates and precise outcomes could range. Market circumstances and particular person funding selections play a vital function.

Funding Targets and Systematic Plans

Systematic fairness plans could be tailored to fulfill numerous monetary objectives past retirement. A younger skilled, for instance Mark, may use a scientific plan to avoid wasting for a down cost on a home. He might put aside a selected proportion of his revenue every month to spend money on a diversified actual property funding belief (REIT) portfolio. The constant contributions, together with compounding returns, will assist him attain his goal sooner.

Moreover, a scientific plan could possibly be employed to fund a toddler’s training. A father or mother might contribute a hard and fast quantity month-to-month to an training financial savings plan, making the most of tax advantages and probably substantial development. This method ensures constant contributions, minimizing the impression of market fluctuations, and selling constant development. These examples present how systematic plans could be aligned with numerous objectives.

Development Potential of Systematic Fairness Plans

The compounding impact of constant investments is a major issue within the development potential of systematic fairness plans. Over time, the returns earned on investments are reinvested, producing additional returns. This exponential development is essential for reaching long-term monetary objectives. Take into account a state of affairs the place somebody invests $100 month-to-month in a diversified portfolio with a median annual return of 8%.

After 10 years, the accrued worth might exceed $15,000, demonstrating the facility of compounding and constant contributions.

Closing Wrap-Up

In conclusion, a scientific fairness plan gives a disciplined and constant method to investing in equities. By understanding the different sorts, advantages, dangers, and implementation steps, you may tailor a plan that aligns along with your particular person monetary objectives. This structured method presents the potential for long-term wealth constructing, however requires cautious consideration of your threat tolerance and market circumstances.

Finally, a well-defined and managed systematic fairness plan can considerably improve your probabilities of reaching monetary success.

Basic Inquiries

What are the widespread funding frequencies for systematic fairness plans?

Frequent frequencies embrace month-to-month, quarterly, and even annual contributions, tailor-made to your funds and funding objectives.

How do I select the precise investments for my systematic fairness plan?

Your funding selections ought to align along with your threat tolerance, monetary objectives, and time horizon. Take into account diversification throughout completely different asset courses and sectors to mitigate threat.

How can I handle the danger related to market volatility in a scientific fairness plan?

Diversification, long-term investing, and common rebalancing are key methods for managing the impression of market fluctuations in your systematic fairness plan.

What are the potential charges and bills related to a scientific fairness plan?

Charges can range considerably based mostly on the plan supplier and funding selections. Evaluating charges and bills throughout completely different suppliers is essential for optimum returns.

What’s the function of threat tolerance in growing a scientific fairness plan?

Understanding your threat tolerance is crucial. The next threat tolerance may permit for extra aggressive funding selections, whereas a decrease threat tolerance will lean in direction of extra conservative choices.