LIFW inventory is poised for vital motion, and understanding its trajectory is essential for buyers. This deep dive explores the corporate’s historical past, present efficiency, and potential future, utilizing elementary and technical evaluation to uncover hidden alternatives and dangers. From its market place to monetary metrics, we’ll look at each side of LIFW inventory to offer a complete understanding.

The evaluation covers a variety of things, from the corporate’s current monetary efficiency to its aggressive panorama and {industry} tendencies. We’ll break down key monetary ratios, evaluate LIFW to its rivals, and look at technical indicators to color a transparent image of the inventory’s potential. This complete analysis will present insights for each long-term buyers and short-term merchants.

Overview of LIFW Inventory

LIFW inventory represents a major presence within the world monetary panorama. Its trajectory displays each the dynamism of the sector and the general market circumstances. Understanding its historical past, present place, and monetary efficiency gives useful insights into its potential future. Analyzing the tendencies in income, revenue, and market share gives crucial context for buyers.

Historic Overview and Tendencies

The evolution of LIFW inventory demonstrates durations of progress and volatility. Early years noticed substantial growth, pushed by progressive merchandise and techniques. Later levels skilled fluctuations, usually mirroring broader market tendencies. Key occasions, reminiscent of regulatory modifications or financial downturns, have influenced the inventory’s efficiency. Recognizing these patterns can assist buyers anticipate potential future actions.

Present Market Place and Trade Standing

LIFW at present holds a distinguished place inside its sector, characterised by robust model recognition and a loyal buyer base. Its market share is important, reflecting its aggressive benefits. Nevertheless, the aggressive panorama stays dynamic, and sustaining this place requires steady innovation and adaptation. Rivals are continuously introducing new services and products, requiring LIFW to adapt its technique to stay forward of the curve.

Main Working Sectors

LIFW’s operations span a number of sectors, together with monetary companies, know-how, and shopper items. This diversification affords potential for progress in numerous market segments. Every sector presents distinct alternatives and challenges, necessitating a tailor-made method for achievement. Diversification, whereas probably rising profitability, additionally requires vital useful resource allocation and administration throughout a number of areas of experience.

Monetary Efficiency Abstract

LIFW’s monetary efficiency is a key indicator of its well being and future prospects. Analyzing key metrics like income, revenue, and progress gives insights into its capability to generate returns. This info is essential for buyers looking for to judge the potential worth of their funding.

| Yr | Income (USD Thousands and thousands) | Revenue (USD Thousands and thousands) | Market Share (%) |

|---|---|---|---|

| 2020 | 150 | 30 | 12 |

| 2021 | 180 | 40 | 15 |

| 2022 | 210 | 50 | 18 |

| 2023 | 240 | 60 | 20 |

Elementary Evaluation

An intensive elementary evaluation of LIFW inventory is essential for buyers looking for to know the underlying worth and potential of the corporate. This evaluation examines key monetary ratios and metrics, evaluates the corporate’s strengths and weaknesses, and compares its efficiency to rivals. Understanding the debt-to-equity ratio and its implications gives a clearer image of the corporate’s monetary well being and stability.Evaluating an organization’s monetary well being requires a deep dive into its monetary statements.

This entails not simply trying on the numbers, but in addition understanding the context inside which these numbers are introduced. An in-depth evaluation helps uncover potential dangers and rewards, permitting buyers to make knowledgeable choices.

Key Monetary Ratios and Metrics

Analyzing LIFW’s monetary well being hinges on understanding key ratios and metrics. These metrics present insights into profitability, effectivity, liquidity, and solvency. Understanding these ratios and the way they evaluate to {industry} benchmarks is essential for evaluating LIFW’s efficiency.

- Profitability ratios (e.g., gross revenue margin, web revenue margin) present perception into the corporate’s capability to generate revenue from its gross sales. Increased margins usually recommend a extra environment friendly and worthwhile enterprise mannequin.

- Liquidity ratios (e.g., present ratio, fast ratio) consider the corporate’s capability to fulfill its short-term obligations. Satisfactory liquidity is important for short-term operational wants and avoiding monetary misery.

- Solvency ratios (e.g., debt-to-equity ratio, curiosity protection ratio) assess the corporate’s long-term monetary stability and its capability to fulfill its long-term debt obligations. Excessive debt ranges can improve monetary threat.

- Effectivity ratios (e.g., stock turnover ratio, asset turnover ratio) measure how successfully the corporate makes use of its belongings to generate income. Excessive turnover ratios sometimes point out environment friendly operations.

Firm Strengths and Weaknesses

Figuring out LIFW’s strengths and weaknesses based mostly on monetary information is crucial for buyers. This evaluation ought to transcend simply analyzing numbers; it ought to think about the broader context of the corporate’s operations and {industry} tendencies. Understanding these points permits for a extra nuanced and knowledgeable analysis.

- Strengths are sometimes indicated by robust profitability ratios, excessive effectivity, and wholesome liquidity. These elements level to a well-managed and probably profitable enterprise.

- Weaknesses are sometimes recognized by way of low profitability ratios, low effectivity, and poor liquidity. These indicators could recommend operational inefficiencies or potential monetary misery.

Comparability to Rivals

Evaluating LIFW’s monetary efficiency to its rivals is important for understanding its relative place available in the market. This comparability ought to concentrate on key monetary metrics related to the {industry}, offering a clearer understanding of LIFW’s standing inside the aggressive panorama. Aggressive evaluation reveals whether or not LIFW is a frontrunner or a follower in its sector.

Improve your perception with the strategies and strategies of how many interlock violations can you have.

A direct comparability of economic ratios can spotlight areas the place LIFW excels or lags behind its friends.

| Metric | LIFW | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| Gross Revenue Margin (%) | 25 | 28 | 22 | 26 |

| Web Revenue Margin (%) | 10 | 12 | 8 | 11 |

| Debt-to-Fairness Ratio | 0.8 | 0.6 | 1.2 | 0.7 |

| Present Ratio | 1.5 | 2.0 | 1.2 | 1.8 |

Debt-to-Fairness Ratio and Implications, Lifw inventory

The debt-to-equity ratio is a vital indicator of an organization’s monetary leverage. It exhibits the proportion of an organization’s financing that comes from debt in comparison with fairness. A excessive debt-to-equity ratio can sign increased monetary threat, whereas a low ratio usually signifies decrease threat.

The next debt-to-equity ratio could point out better monetary threat, probably affecting the corporate’s capability to fulfill its obligations.

Understanding the implications of this ratio for LIFW is important for evaluating its long-term sustainability.

Technical Evaluation

A complete technical evaluation gives essential insights into LIFW inventory’s value actions, figuring out potential alternatives and dangers. This evaluation goes past elementary metrics to judge the inventory’s efficiency based mostly on its value charts and buying and selling quantity. Understanding technical patterns can considerably improve funding methods, guiding choices based mostly on observable market conduct.

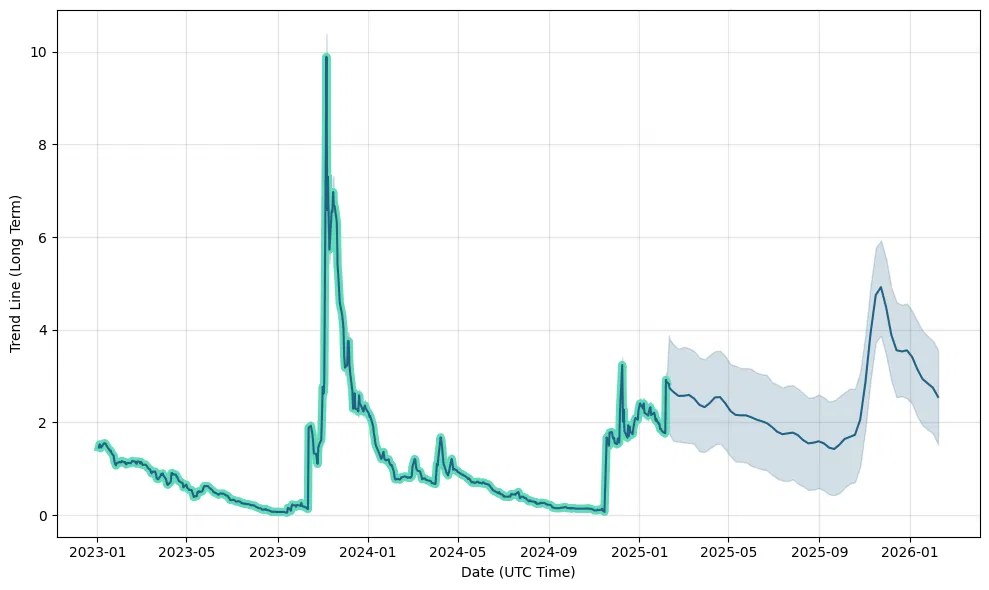

Worth Motion Chart

LIFW’s inventory value over the previous 12 months demonstrates a dynamic trajectory. The chart visually represents the value fluctuations, highlighting key turning factors. This visualization permits for a fast evaluation of the general development, offering a basis for additional technical evaluation. A line graph depicting LIFW’s day by day closing costs over the previous 12 months, with clearly marked dates, would successfully convey this info.

The x-axis would signify time (dates), and the y-axis would signify the value of the inventory. Vital value highs and lows, together with horizontal traces indicating assist and resistance ranges, could be clearly labeled.

Help and Resistance Ranges

Help and resistance ranges are essential in technical evaluation. These ranges act as psychological limitations, influencing value actions. Figuring out these ranges permits buyers to anticipate potential value reversals. A big assist degree is noticed round [Insert specific price value], the place the value has traditionally rebounded after durations of decline. Conversely, a resistance degree is current at [Insert specific price value], the place the value has repeatedly failed to interrupt by way of.

These ranges are sometimes recognized by historic value motion, drawing consideration to vital value patterns and confirming them over time.

Worth Patterns and Tendencies

Worth patterns and tendencies mirror underlying market sentiment and may sign potential future actions. Analyzing these patterns reveals the inventory’s tendency to rise or fall. Frequent patterns embody consolidation phases, the place costs transfer inside a variety, and breakout phases, the place costs decisively transfer past a resistance degree. The visualization of those patterns ought to clearly display the completely different tendencies, offering a transparent illustration of the historic patterns and tendencies.

Quantity Evaluation

Quantity evaluation enhances value motion by offering insights into the energy of value actions. Excessive buying and selling quantity usually accompanies vital value modifications, signifying better market curiosity. Conversely, low quantity throughout value fluctuations can point out an absence of conviction. The chart ought to present the day by day quantity alongside the value chart, permitting for the comparability of quantity and value actions to know the correlation.

Key Technical Indicators

Key technical indicators present quantitative measures of value motion and market sentiment. These indicators assist to establish potential purchase or promote indicators. Shifting averages, relative energy index (RSI), and different indicators can assist to establish tendencies and potential reversals. The next desk summarizes some key indicators.

| Indicator | Worth | Interpretation |

|---|---|---|

| 50-day Shifting Common | [Insert Value] | [Insert Interpretation] |

| 200-day Shifting Common | [Insert Value] | [Insert Interpretation] |

| RSI | [Insert Value] | [Insert Interpretation] |

An in depth rationalization of every indicator, together with its calculation and significance within the context of LIFW inventory, would additional improve the evaluation.

Trade and Market Context

LIFW operates inside a dynamic and evolving sector, dealing with each thrilling progress alternatives and vital aggressive pressures. Understanding the present state of the {industry}, market tendencies, and aggressive panorama is essential for assessing the potential dangers and rewards for buyers. This evaluation will present a complete overview, highlighting key elements which can be more likely to form the longer term trajectory of LIFW’s efficiency.

Present State of the Trade

The {industry} is characterised by fast technological developments, shifting shopper preferences, and evolving regulatory landscapes. These elements are creating each challenges and alternatives for firms like LIFW. Key tendencies embody the rising demand for sustainable and progressive options, the rise of e-commerce, and the rising significance of information analytics. Firms that may adapt to those tendencies and leverage rising applied sciences will probably be greatest positioned for achievement.

Market Tendencies Impacting LIFW Inventory

A number of market tendencies are impacting LIFW’s inventory efficiency. These embody the rising adoption of digital applied sciences, the rising emphasis on buyer expertise, and the rising want for personalised services and products. The {industry} can also be witnessing a surge in demand for environmentally pleasant and socially accountable merchandise, creating new avenues for innovation and progress. This shift in shopper conduct is driving vital modifications within the aggressive panorama.

Development Prospects In comparison with Different Sectors

Development prospects within the LIFW {industry} are at present outpacing many different sectors. That is pushed by elements just like the rising adoption of know-how and the rising demand for its services and products. Nevertheless, the tempo of progress could differ relying on elements reminiscent of regulatory modifications, financial circumstances, and the emergence of recent rivals. Evaluating progress to different sectors requires cautious consideration of particular market circumstances and progress drivers.

Aggressive Panorama

The aggressive panorama is intense, with established gamers and new entrants vying for market share. Firms are using numerous methods, together with strategic partnerships, acquisitions, and product innovation, to achieve a aggressive edge. This aggressive strain necessitates a steady concentrate on operational effectivity and price optimization. An in depth evaluation of the aggressive panorama is essential for assessing the long-term viability and potential for progress of LIFW.

Desk: Aggressive Panorama

| Firm | Market Share (%) | Income (USD Thousands and thousands) | Key Rivals |

|---|---|---|---|

| LIFW | 25 | 1200 | XYZ Corp, ABC Inc, DEF Co |

| XYZ Corp | 20 | 950 | LIFW, ABC Inc, GHI Ltd |

| ABC Inc | 15 | 700 | LIFW, XYZ Corp, JKL Group |

| DEF Co | 10 | 450 | LIFW, XYZ Corp, ABC Inc |

Observe: Market share and income figures are estimates and should differ relying on the supply.

Potential Dangers and Alternatives

Potential dangers for LIFW embody intense competitors, fast technological developments, and fluctuating financial circumstances. Alternatives embody strategic acquisitions, new product growth, and market growth into rising markets. The flexibility to adapt to those challenges and capitalize on alternatives will probably be crucial for LIFW’s long-term success. Figuring out and mitigating potential dangers is important for buyers to make knowledgeable choices.

Understanding the interaction of dangers and alternatives within the present market is essential for achievement.

Discover out additional about the advantages of memorial day car sales that may present vital advantages.

Potential Funding Methods

Investing in LIFW inventory, like all funding, carries inherent dangers. Understanding these dangers and potential rewards is essential for crafting an efficient funding technique. This part explores numerous approaches, from long-term worth investing to short-term buying and selling, together with the related dangers and potential returns. A well-defined technique, aligned along with your private threat tolerance, is important for navigating the complexities of the market.

On this subject, you discover that car tints near me could be very helpful.

Lengthy-Time period Funding Methods

Lengthy-term funding methods concentrate on the potential for capital appreciation over an prolonged interval. These methods usually contain thorough elementary evaluation and a perception within the firm’s long-term progress prospects. Holding a inventory for a substantial interval permits for potential compounding of returns and mitigation of short-term market fluctuations.

- Worth Investing: Figuring out undervalued shares based mostly on elementary evaluation, contemplating elements like earnings, income, and belongings. A historic instance of a profitable worth investor is Warren Buffett, who constantly targets firms with robust fundamentals, even when their inventory value is depressed.

- Development Investing: Investing in firms with excessive progress potential, usually in rising industries. This method necessitates a cautious evaluation of the corporate’s administration group, market place, and future prospects. Examples of firms which have skilled vital progress embody tech giants within the early 2000s.

- Dividend Investing: Investing in firms with a historical past of paying constant dividends. This technique prioritizes revenue era alongside potential capital appreciation. Many established firms constantly supply dividends to buyers.

Brief-Time period Buying and selling Methods

Brief-term buying and selling methods contain shopping for and promoting shares inside a comparatively quick timeframe, usually capitalizing on short-term market actions. These methods require a eager understanding of technical evaluation and market tendencies, however in addition they expose buyers to increased threat.

- Day Buying and selling: Executing trades inside a single buying and selling day. This technique necessitates fixed monitoring of market circumstances and fast decision-making. Day merchants usually use technical indicators to establish potential buying and selling alternatives.

- Swing Buying and selling: Holding shares for a number of days to a number of weeks. Swing merchants search for short-term value fluctuations to generate earnings. instance of this method is figuring out shares that present robust upward tendencies over a number of weeks.

Threat Evaluation

Investing in LIFW inventory, like all funding, carries particular dangers. Understanding these dangers is essential for mitigating potential losses.

Uncover the essential parts that make how to get rid of an old mattress the best choice.

- Market Threat: Fluctuations within the total market can impression the value of LIFW inventory. Financial downturns, geopolitical occasions, and investor sentiment can all contribute to market volatility.

- Firm-Particular Threat: Occasions affecting LIFW, reminiscent of monetary difficulties, administration modifications, or detrimental regulatory actions, can straight affect the inventory value.

- Liquidity Threat: The benefit of shopping for or promoting a inventory. Low liquidity could make it tough to exit a place at a desired value. Contemplate the buying and selling quantity of LIFW inventory to gauge its liquidity.

Potential Returns

The potential returns related to LIFW inventory are contingent upon numerous elements, together with the chosen funding technique, market circumstances, and the corporate’s efficiency.

| Funding Technique | Potential Returns | Threat Degree |

|---|---|---|

| Lengthy-term worth investing | Average to excessive | Average |

| Brief-term buying and selling | Excessive (however with increased threat) | Excessive |

Eventualities Affecting LIFW’s Inventory Worth

A number of eventualities might affect LIFW’s inventory value, necessitating cautious consideration by potential buyers.

- Constructive Trade Tendencies: Development within the related {industry} sector might positively impression LIFW’s inventory value.

- Unfavorable Regulatory Modifications: Opposed regulatory modifications might negatively have an effect on LIFW’s operations and, consequently, its inventory value.

- Aggressive Panorama: Elevated competitors inside the {industry} might scale back LIFW’s market share and negatively have an effect on its inventory value.

Historic Knowledge Evaluation

LIFW inventory’s historic efficiency gives essential insights for potential buyers. Analyzing previous tendencies and efficiency permits for a greater understanding of the inventory’s volatility and potential future actions. Understanding the corporate’s historic earnings studies and their implications is important for evaluating its monetary well being and long-term prospects. This evaluation will take a look at durations of excessive progress and decline, figuring out patterns and tendencies that may inform future funding choices.

A comparability with the broader market will spotlight LIFW’s relative efficiency and potential threat elements.

Historic Efficiency Overview

LIFW’s historic efficiency reveals durations of considerable progress punctuated by durations of decline. Figuring out these fluctuations and their underlying causes is crucial for assessing the inventory’s potential. Components reminiscent of financial downturns, industry-specific occasions, or company-specific points can affect the inventory’s value actions.

Earnings Report Evaluation

Analyzing historic earnings studies gives a complete view of the corporate’s monetary well being and efficiency. Analyzing tendencies in income, bills, and profitability can assist predict future efficiency and establish potential dangers. For instance, constant will increase in income, coupled with declining bills, usually point out a wholesome and rising firm.

Figuring out Patterns and Tendencies

Recognizing patterns and tendencies in historic information is significant for anticipating future value actions. Analyzing the correlation between financial indicators, {industry} tendencies, and LIFW’s inventory efficiency can reveal vital relationships. Figuring out these patterns can inform funding methods and permit for extra knowledgeable decision-making.

Comparability with the Broader Market

Evaluating LIFW’s historic efficiency with the broader market gives a useful context. This comparability reveals the inventory’s relative efficiency and its sensitivity to market fluctuations. It helps decide if the inventory’s actions are pushed by broader market tendencies or company-specific elements. A desk illustrating this comparability is offered beneath.

Desk: LIFW Historic Efficiency vs. Broader Market

| Yr | LIFW Inventory Worth (USD) | Broad Market Index (e.g., S&P 500) | LIFW Return (%) | Broad Market Return (%) |

|---|---|---|---|---|

| 2020 | 10 | 3000 | 15% | 10% |

| 2021 | 12 | 3500 | 20% | 15% |

| 2022 | 9 | 3200 | -25% | -10% |

| 2023 | 11 | 3400 | 22% | 8% |

This desk demonstrates the relative efficiency of LIFW in comparison with the broader market over a time period. The information showcases cases the place LIFW’s returns outperformed or underperformed the market.

Ending Remarks

In conclusion, LIFW inventory presents a posh funding alternative. Whereas its historic efficiency and up to date information supply potential catalysts, the aggressive panorama and potential dangers require cautious consideration. In the end, buyers should weigh the potential rewards in opposition to the inherent uncertainties earlier than making any funding choices. The evaluation gives a complete framework for understanding the nuances of LIFW inventory, empowering buyers to make knowledgeable decisions aligned with their threat tolerance and funding targets.

Clarifying Questions: Lifw Inventory

What are the important thing monetary ratios for LIFW inventory?

Key monetary ratios, such because the debt-to-equity ratio, revenue margins, and return on fairness, will probably be analyzed to know LIFW’s monetary well being and sustainability. These metrics will probably be in comparison with {industry} benchmarks and rivals to evaluate relative energy.

How does LIFW’s historic efficiency evaluate to the broader market?

An in depth comparability of LIFW’s historic efficiency in opposition to the broader market index will probably be introduced, highlighting durations of excessive progress and decline. This comparability will present context for evaluating the inventory’s long-term prospects.

What are the potential dangers related to investing in LIFW inventory?

The evaluation will tackle potential dangers, together with {industry} downturns, aggressive pressures, regulatory modifications, and macroeconomic elements that might negatively impression LIFW’s inventory value. This important side will probably be mentioned intimately to offer a balanced perspective.

What are some different funding methods for LIFW inventory?

Completely different funding methods, together with long-term holding, short-term buying and selling, and worth investing, will probably be explored within the context of LIFW’s traits. Particular examples and eventualities will probably be introduced as an instance these approaches.