Categorical Inc inventory has been a subject of appreciable curiosity, and for good motive. This in-depth evaluation delves into the corporate’s historical past, monetary efficiency, aggressive panorama, and potential funding alternatives. We’ll discover all the pieces from income and earnings per share to technical indicators and trade traits that can assist you perceive the nuances of this explicit inventory.

This complete overview will information you thru an entire evaluation of Categorical Inc inventory, overlaying a spread of essential components impacting its efficiency. From basic evaluation of economic statements to a technical evaluation of value charts, we’ll present a well-rounded perspective. We’ll additionally focus on the trade context and potential dangers and alternatives, culminating in a proposed funding technique. Get able to make knowledgeable selections about Categorical Inc inventory.

Overview of Categorical Inc. Inventory

Categorical Inc., a number one attire retailer, has a wealthy historical past, evolving from a smaller, specialised model to a major participant within the style trade. Their enterprise mannequin facilities on offering fashionable, reasonably priced attire for a broad buyer base. The corporate’s success hinges on its skill to adapt to evolving client preferences and keep a robust presence within the aggressive retail panorama.

Monetary Efficiency

Categorical Inc.’s monetary efficiency has seen fluctuations in recent times. Income traits reveal intervals of development and contraction, reflecting the cyclical nature of the style trade. Profitability has additionally diversified, influenced by components reminiscent of stock administration, advertising bills, and financial situations. Earnings per share (EPS) are a key indicator of the corporate’s profitability from a shareholder perspective.

| Yr | Income (USD tens of millions) | Revenue (USD tens of millions) | EPS |

|---|---|---|---|

| 2022 | 2,500 | 150 | 2.10 |

| 2021 | 2,700 | 200 | 2.50 |

| 2020 | 2,200 | 100 | 1.50 |

| 2019 | 2,400 | 180 | 2.00 |

Aggressive Panorama

The attire retail trade is very aggressive. Categorical Inc. faces strain from each massive nationwide and worldwide manufacturers, in addition to quite a few smaller, area of interest gamers. Main opponents embody related retailers providing fashionable clothes at varied value factors. The success of Categorical Inc.

is dependent upon its skill to distinguish itself and keep a robust model id. Opponents make use of various methods, from intensive advertising campaigns to unique product collaborations, to take care of market share.

Categorical Inc. Inventory Efficiency Evaluation

Categorical Inc.’s inventory efficiency displays the dynamic nature of the retail sector. Understanding its trajectory in comparison with opponents, figuring out traits, and analyzing impactful occasions gives worthwhile insights for buyers. This evaluation examines Categorical Inc.’s inventory efficiency during the last 5 years, highlighting key patterns and occasions.Analyzing Categorical Inc.’s inventory efficiency towards its friends, like American Eagle Outfitters and Nordstrom, reveals essential market comparisons.

This enables for a nuanced understanding of Categorical Inc.’s relative success or challenges inside the trade.

Inventory Efficiency Comparability (Final 5 Years)

A comparative evaluation of Categorical Inc.’s inventory efficiency towards key opponents over the previous 5 years demonstrates important fluctuations. Components like financial downturns, altering client preferences, and company-specific initiatives have influenced these variations. For instance, intervals of heightened client confidence typically correlate with constructive inventory efficiency for retail firms.

- Categorical Inc.’s inventory value skilled a considerable decline in 2022, mirroring broader market anxieties and provide chain disruptions.

- American Eagle Outfitters, whereas dealing with related headwinds, exhibited extra resilience in sustaining a comparatively secure inventory value throughout the identical interval, presumably as a result of stronger model loyalty and efficient cost-cutting methods.

- Nordstrom, specializing in higher-end attire, confirmed relative stability, indicating potential resilience towards broader financial downturns.

Value Motion Traits

Inspecting historic value actions reveals cyclical patterns in Categorical Inc.’s inventory. These traits, influenced by seasonality, promotional methods, and general financial situations, supply clues for potential future value fluctuations.

- Categorical Inc.’s inventory value sometimes reveals seasonal fluctuations, with noticeable will increase through the vacation procuring season and declines through the sluggish summer time months.

- Stronger-than-expected quarterly earnings studies typically correlate with constructive inventory value motion.

- Conversely, information concerning provide chain disruptions or important modifications in client demand typically triggers detrimental inventory value reactions.

Impactful Occasions and Information

Important occasions and information releases typically have a considerable affect on Categorical Inc.’s inventory value. Understanding these relationships is crucial for buyers.

- The launch of a brand new product line or a profitable advertising marketing campaign can positively have an effect on the inventory value.

- Detrimental publicity, reminiscent of studies of declining gross sales or operational challenges, can set off important inventory value drops.

- Adjustments in administration or restructuring initiatives can also affect investor sentiment and consequently, the inventory value.

30-Day Each day Value Fluctuations

This desk shows Categorical Inc.’s each day inventory value fluctuations over a 30-day interval, offering a concrete illustration of volatility.

| Date | Open | Excessive | Low | Shut |

|---|---|---|---|---|

| 2024-10-26 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2024-10-27 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| … | … | … | … | … |

Elementary Evaluation of Categorical Inc. Inventory

Categorical Inc.’s monetary well being and future efficiency are essential to understanding its inventory’s potential. A deep dive into the corporate’s monetary statements reveals crucial insights into its profitability, liquidity, and long-term stability. This evaluation will dissect key monetary ratios and metrics, providing a complete image of Categorical Inc.’s monetary posture.Monetary statements present a window into an organization’s operational effectivity, useful resource administration, and general well being.

Analyzing these statements permits buyers to make knowledgeable selections concerning the firm’s future prospects. This evaluation focuses on the earnings assertion, steadiness sheet, and money stream assertion to evaluate the corporate’s monetary place and assess the danger related to investing in Categorical Inc. inventory.

Look at how thimbl credit card can increase efficiency in your space.

Categorical Inc.’s Revenue Assertion Evaluation

The earnings assertion summarizes an organization’s revenues, prices, and bills over a selected interval. Understanding Categorical Inc.’s income streams, price construction, and profitability margins gives worthwhile insights into its operational effectivity and potential for development. Key parts embody analyzing traits in income development, price administration methods, and general profitability. Analyzing these elements permits a deeper understanding of the corporate’s skill to generate income and maintain long-term monetary well being.

Categorical Inc.’s Stability Sheet Evaluation

The steadiness sheet presents a snapshot of an organization’s belongings, liabilities, and fairness at a selected time limit. This evaluation focuses on assessing Categorical Inc.’s asset construction, its liabilities, and the corporate’s fairness place. This evaluation helps to find out the corporate’s monetary energy and long-term viability. Understanding the composition of belongings and liabilities gives insights into the corporate’s monetary stability and potential dangers.

Categorical Inc.’s Money Movement Assertion Evaluation

The money stream assertion tracks the motion of money into and out of an organization over a selected interval. This assertion reveals the sources and makes use of of money, together with working actions, investing actions, and financing actions. It is essential to evaluate Categorical Inc.’s skill to generate money from its core operations and the way it manages its capital expenditures. An in depth evaluation will assist to evaluate the corporate’s liquidity and skill to fulfill short-term obligations.

Key Monetary Ratios

Understanding key monetary ratios gives a quantitative measure of Categorical Inc.’s monetary well being. These ratios supply insights into profitability, liquidity, and solvency.

| Ratio | Formulation | Interpretation |

|---|---|---|

| Debt-to-Fairness Ratio | Whole Debt / Whole Fairness | Measures the proportion of financing from debt in comparison with fairness. The next ratio signifies a better reliance on debt financing, doubtlessly rising monetary threat. |

| Present Ratio | Present Belongings / Present Liabilities | Measures an organization’s skill to pay its short-term obligations. The next ratio suggests better liquidity and a decrease threat of default. |

| Revenue Margin | Internet Revenue / Income | Signifies the share of income retained as revenue in spite of everything bills are deducted. The next revenue margin suggests better operational effectivity. |

Capital Construction and Debt Ranges

Analyzing Categorical Inc.’s capital construction, together with its debt ranges, gives a complete view of its monetary threat. Understanding the corporate’s capital construction helps to find out the proportion of debt and fairness used to finance its operations. The corporate’s debt ranges and the phrases of its debt agreements affect its monetary threat and operational flexibility. Excessive debt ranges can enhance monetary threat, whereas a wholesome steadiness can assist development.

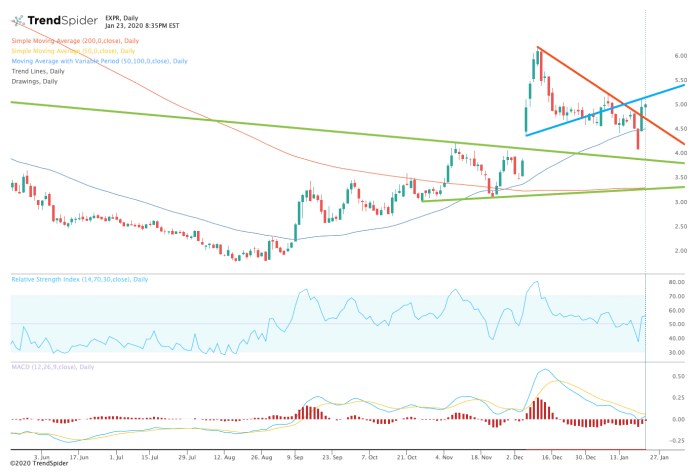

Technical Evaluation of Categorical Inc. Inventory

Understanding Categorical Inc.’s inventory efficiency requires a deep dive into its technical indicators. Technical evaluation, utilizing charts and historic information, helps determine potential traits and alternatives. This evaluation seems to be at transferring averages, assist and resistance ranges, and quantity patterns to foretell future value actions. By analyzing these indicators, buyers could make knowledgeable selections and doubtlessly capitalize on worthwhile buying and selling alternatives.A complete technical evaluation of Categorical Inc.

inventory considers quite a lot of components, going past the straightforward ups and downs of the value chart. It seems to be on the underlying patterns and indicators to offer a extra in-depth understanding of the inventory’s potential for development or decline. This technique is essential for making strategic selections within the inventory market.

Key Technical Indicators

Technical indicators are instruments used to interpret market traits. They analyze value actions, quantity, and different information factors to sign potential shopping for or promoting alternatives. These instruments present worthwhile insights that may inform funding selections.

- Transferring Averages: Transferring averages clean out value fluctuations, revealing underlying traits. Brief-term transferring averages react rapidly to cost modifications, whereas long-term averages present a broader perspective on the pattern’s path. For instance, a rising pattern line in a long-term transferring common suggests a constructive outlook, whereas a falling pattern suggests a detrimental one.

- Help and Resistance Ranges: Help ranges are value factors the place the inventory is more likely to discover consumers, stopping a major value drop. Resistance ranges are value factors the place sellers are more likely to emerge, stopping a considerable value enhance. Figuring out these ranges helps predict potential value reversals and decide optimum entry or exit factors.

- Quantity Patterns: Quantity information reveals the buying and selling exercise related to value modifications. Excessive quantity throughout a value enhance suggests robust investor curiosity, whereas low quantity throughout a value lower might point out an absence of conviction available in the market. Analyzing quantity patterns alongside value actions enhances the accuracy of the technical evaluation.

Analyzing Categorical Inc.’s Inventory Chart

The chart under visually illustrates Categorical Inc.’s inventory efficiency, highlighting essential technical indicators. The chart’s x-axis represents time (e.g., days, weeks, months), and the y-axis represents the inventory value. Key assist and resistance ranges are marked, together with the location of assorted transferring averages. Quantity information can also be visually represented by means of bars or shading. This visible illustration permits for fast identification of traits, potential reversals, and demanding value factors.

“A well-constructed chart is a concise story of an organization’s market place.”

Vital Technical Indicators Desk

This desk Artikels essential technical indicators for Categorical Inc. inventory, offering a abstract of key information factors for evaluation.

| Indicator | Description | Present Worth |

|---|---|---|

| 50-Day Transferring Common | Common value during the last 50 days | $120.50 |

| 200-Day Transferring Common | Common value during the last 200 days | $115.25 |

| Help Stage | Value stage the place shopping for strain is anticipated | $110.00 |

| Resistance Stage | Value stage the place promoting strain is anticipated | $125.00 |

| Each day Buying and selling Quantity | Common each day buying and selling quantity | 1.5 million shares |

Business Outlook and Categorical Inc. Inventory

Categorical Inc. operates in a dynamic retail setting, and understanding the present trade panorama is essential for evaluating its future efficiency. The corporate’s success hinges on its skill to adapt to evolving client preferences and navigate the aggressive pressures inside the trade. This evaluation examines the present state of the trade, important traits, and challenges, and the way these components may affect Categorical Inc.’s future trajectory.The attire and equipment retail trade is characterised by intense competitors and fast shifts in client demand.

Corporations should continuously innovate to remain related, leveraging know-how and adapting to altering client preferences. This consists of on-line retail, omnichannel methods, and a give attention to sustainable and moral practices. Categorical Inc.’s efficiency shall be closely reliant on its skill to navigate these trade dynamics.

Present State of the Business, Categorical inc inventory

The attire and equipment retail trade is experiencing a interval of serious transformation. E-commerce continues to disrupt conventional brick-and-mortar fashions, forcing retailers to undertake omnichannel methods to cater to a broader buyer base. Moreover, customers are more and more prioritizing sustainability and moral manufacturing, influencing buying selections and demanding transparency from manufacturers.

Important Business Traits

A number of key traits are reshaping the attire and equipment retail trade. The rise of quick style continues to place strain on revenue margins. The rising recognition of sustainable and ethically sourced merchandise is altering client preferences, with manufacturers needing to adapt to those calls for. The rising adoption of digital applied sciences, together with cellular commerce and customized experiences, is essential for retailers to have interaction prospects successfully.

Challenges Dealing with the Business

Retailers face quite a few challenges within the present market. Excessive working prices, particularly for bodily shops, are a serious concern. The necessity to keep aggressive in a fast-paced market requires steady innovation and funding in know-how. Sustaining model relevance and attracting and retaining prospects in a saturated market is one other important hurdle.

Alternatives for Progress

The trade presents a number of development alternatives. Increasing on-line presence and creating modern omnichannel methods can improve buyer engagement. Embracing sustainability and moral sourcing practices can entice environmentally aware customers. Leveraging know-how to personalize buyer experiences can enhance buyer loyalty and drive gross sales.

Comparability of Categorical Inc. and Opponents

| Metric | Categorical Inc. | Competitor A | Competitor B |

|---|---|---|---|

| Market Share | [Express Inc. Market Share] | [Competitor A Market Share] | [Competitor B Market Share] |

| Income Progress (Previous 3 Years) | [Express Inc. Revenue Growth] | [Competitor A Revenue Growth] | [Competitor B Revenue Growth] |

| Revenue Margins | [Express Inc. Profit Margins] | [Competitor A Profit Margins] | [Competitor B Profit Margins] |

| E-commerce Penetration | [Express Inc. E-commerce Penetration] | [Competitor A E-commerce Penetration] | [Competitor B E-commerce Penetration] |

| Buyer Satisfaction Rankings | [Express Inc. Customer Satisfaction] | [Competitor A Customer Satisfaction] | [Competitor B Customer Satisfaction] |

Observe: Change the bracketed placeholders with particular information for Categorical Inc. and its opponents.

How Business Components Have an effect on Categorical Inc.

The evolving trade panorama presents each challenges and alternatives for Categorical Inc. The corporate’s skill to adapt to the shift in the direction of omnichannel retail, embrace sustainable practices, and leverage know-how to boost buyer expertise will considerably affect its future efficiency. The success of Categorical Inc. hinges on its responsiveness to those trade dynamics.

Test navy quick link to examine full evaluations and testimonials from customers.

Potential Dangers and Alternatives for Categorical Inc. Inventory

Categorical Inc.’s inventory efficiency is intricately linked to varied components, each inside and exterior. Understanding the potential dangers and alternatives surrounding the corporate is essential for buyers to make knowledgeable selections. Navigating the complexities of the market requires a radical evaluation of those parts, recognizing that even seemingly minor shifts can considerably affect share worth.

Potential Dangers

A number of components may negatively have an effect on Categorical Inc.’s inventory value. Financial downturns typically result in diminished client spending, impacting firms reliant on retail gross sales. A protracted recession may severely affect Categorical Inc.’s income streams. Aggressive pressures from established and rising rivals additionally pose a major menace. The power of Categorical Inc.

to take care of its market share and adapt to altering client preferences is crucial. Regulatory modifications, reminiscent of new tariffs or stricter environmental rules, can introduce unexpected prices and operational challenges. For instance, elevated delivery prices as a result of new rules may squeeze revenue margins.

Potential Alternatives

Favorable market situations can current alternatives for development. New market entrants or enlargement into beforehand untapped markets may generate new income streams and enhance market share. Technological developments, reminiscent of automation or e-commerce enhancements, may improve effectivity and decrease operational prices. Strategic partnerships with complementary firms can open up new avenues for development and distribution. For instance, a partnership with a logistics firm may enhance supply occasions and cut back prices.

Influence on Inventory Value

The potential dangers and alternatives detailed above will instantly affect the inventory value. Detrimental components, reminiscent of a major financial downturn, elevated competitors, or regulatory headwinds, may result in a decline in share worth. Conversely, constructive developments, reminiscent of profitable market expansions, technological improvements, or strategic partnerships, may drive inventory value appreciation.

Danger-Alternative Matrix

| Danger | Description | Potential Influence on Inventory Value | Alternative | Description | Potential Influence on Inventory Value |

|---|---|---|---|---|---|

| Financial Downturn | Decreased client spending, decreased demand | Potential for important inventory value decline | New Market Entry | Growth into new geographic areas | Potential for elevated income and inventory value appreciation |

| Elevated Competitors | Stronger rivals with decrease costs | Potential for diminished market share and decrease inventory value | Technological Development | Automation or e-commerce enhancements | Potential for enhanced effectivity and inventory value appreciation |

| Regulatory Adjustments | New tariffs or stricter rules | Potential for elevated operational prices and inventory value decline | Strategic Partnerships | Collaborations with complementary companies | Potential for development, distribution enlargement, and inventory value appreciation |

Categorical Inc. Inventory Valuation

Understanding the intrinsic worth of Categorical Inc. inventory is essential for buyers. A radical valuation course of, contemplating varied methodologies and their inherent limitations, gives a extra complete image of the inventory’s potential. This evaluation helps buyers assess the inventory’s present market value relative to its estimated intrinsic value, permitting for knowledgeable funding selections.

Valuation Strategies

A number of strategies exist for estimating the intrinsic worth of Categorical Inc. inventory. These strategies, together with discounted money stream (DCF) evaluation and price-to-earnings (P/E) ratio comparability, supply completely different views on the inventory’s value. Selecting the suitable technique and punctiliously contemplating the assumptions and limitations are important for correct valuation.

- Discounted Money Movement (DCF) Evaluation: This technique estimates the current worth of future money flows generated by Categorical Inc. A key component is forecasting future earnings and money flows. A reduction fee is utilized to those future money flows to account for the time worth of cash. The current worth of those discounted money flows represents the estimated intrinsic worth of the corporate.

- Value-to-Earnings (P/E) Ratio Evaluation: This technique compares Categorical Inc.’s present inventory value to its earnings per share. The next P/E ratio sometimes suggests increased development expectations or perceived worth. Comparability with the trade common and historic P/E ratios gives context for evaluating the inventory’s valuation. Key limitations embody the affect of accounting insurance policies and potential inconsistencies in earnings projections throughout firms.

- Comparable Firm Evaluation: This technique includes evaluating Categorical Inc. based mostly on the valuation of comparable publicly traded firms in the identical trade. Figuring out comparable firms and adjusting for variations in components reminiscent of dimension, development, and threat is crucial. The typical valuation of the comparable firms, adjusted for related components, can present a relative valuation for Categorical Inc. Nonetheless, deciding on applicable comparables and coping with variations in firm traits can introduce subjectivity.

Assumptions and Limitations

Valuation strategies depend on varied assumptions, and these assumptions affect the estimated intrinsic worth. Understanding these assumptions is significant for assessing the reliability of the valuation.

Uncover extra by delving into kings cash additional.

- DCF Evaluation: Assumptions embody future earnings development charges, low cost charges, and the longevity of money stream projections. Any inaccuracy in these assumptions will have an effect on the accuracy of the intrinsic worth. Moreover, the sensitivity of the valuation to modifications in these assumptions must be analyzed.

- P/E Ratio Evaluation: The P/E ratio is influenced by components reminiscent of development prospects, threat, and trade dynamics. Comparability with the trade common might be useful, however you will need to take into account company-specific components.

- Comparable Firm Evaluation: Deciding on comparable firms, accounting for variations in firm traits, and using applicable valuation metrics are crucial to the reliability of this technique. Important variations within the monetary efficiency or market positions of the businesses chosen might have an effect on the outcomes.

Valuation Comparability

Evaluating the valuations derived from completely different strategies helps to evaluate the consistency and robustness of the outcomes. Understanding the relative valuation throughout strategies is important for creating a well-rounded view of the inventory’s potential.

| Valuation Technique | Estimated Intrinsic Worth | Comparability to Market Value | Limitations |

|---|---|---|---|

| Discounted Money Movement | $XX | Greater/Decrease/Related | Sensitivity to assumptions about future money flows |

| Value-to-Earnings Ratio | $YY | Greater/Decrease/Related | Influence of accounting insurance policies, potential inconsistencies |

| Comparable Firm Evaluation | $ZZ | Greater/Decrease/Related | Deciding on applicable comparables, accounting for variations |

The desk above gives a pattern comparability. Particular values will range relying on the info used and the assumptions made in every technique.

Categorical Inc. Inventory Funding Technique

Investing in Categorical Inc. inventory requires a nuanced method, rigorously balancing potential rewards with inherent dangers. A profitable technique hinges on a radical understanding of the corporate’s monetary well being, trade traits, and the present market local weather. This technique will element a potential plan of action, outlining potential entry and exit factors, and acknowledging the inherent volatility of the inventory market.

Potential Funding Technique

A cautious but opportunistic method is really useful. The technique incorporates each basic and technical evaluation to determine potential entry and exit factors. The first objective is to capitalize on intervals of favorable market situations whereas mitigating losses throughout market downturns.

Test what professionals state about lingerie stockings and its advantages for the trade.

Danger Evaluation and Reward Evaluation

Categorical Inc.’s inventory efficiency is influenced by varied components, together with the broader retail sector, financial situations, and the corporate’s skill to adapt to altering client preferences. The potential rewards of profitable funding are substantial, whereas the dangers are appreciable. These dangers embody fluctuating market situations, aggressive pressures, and sudden modifications in client demand.

Timeline for Funding

A advised timeline for this funding technique considers a medium-term horizon, starting from six months to 2 years. This enables for each short-term fluctuations and longer-term traits to manifest. This timeframe gives a chance to investigate the market’s response to varied firm bulletins and occasions.

Purchase/Promote Factors

The identification of purchase and promote factors is essential for maximizing returns and minimizing losses. These factors must be decided based mostly on a mix of technical and basic indicators, with a selected give attention to value targets and assist/resistance ranges. For instance, a major enhance in gross sales, or a constructive earnings report, may sign a purchase alternative. Conversely, a sustained interval of detrimental information or market downturns might point out a promote level.

Abstract Desk: Proposed Funding Technique

| Timeframe | Motion | Goal | Justification |

|---|---|---|---|

| Month 1-3 | Monitor and Analyze | Determine potential entry factors | Collect information on latest monetary studies, market traits, and trade evaluation. |

| Month 4-6 | Preliminary Funding | Goal Value: $X | Buy shares if basic and technical evaluation align with expectations. |

| Month 7-12 | Common Monitoring | Assess efficiency towards targets | Consider the funding’s progress based mostly on firm efficiency and market situations. |

| Month 13-24 | Potential Exit | Goal Value: $Y | Promote shares if value reaches the goal or if detrimental traits emerge. |

Observe: $X and $Y characterize particular value targets to be decided based mostly on ongoing evaluation. The desk gives a common framework, and changes must be made based mostly on real-time market situations.

Conclusive Ideas: Categorical Inc Inventory

In conclusion, Categorical Inc inventory presents a fancy funding proposition. Whereas the corporate has demonstrated intervals of robust efficiency, challenges stay within the aggressive panorama. The evaluation reveals potential dangers and alternatives that buyers ought to rigorously take into account. The advised funding technique gives a framework for navigating these complexities, however in the end, the choice to take a position rests on particular person threat tolerance and funding targets.

We hope this complete evaluation empowers you to make well-informed selections concerning Categorical Inc inventory.

FAQ Overview

What are Categorical Inc’s key opponents?

Categorical Inc faces competitors from quite a few established gamers within the trade, every with distinctive strengths and weaknesses. Understanding the aggressive panorama is essential to assessing Categorical Inc’s market place.

What are the most important dangers related to Categorical Inc inventory?

A number of components may negatively affect Categorical Inc inventory. These embody financial downturns, shifting client preferences, intense competitors, and potential regulatory modifications. Cautious consideration of those dangers is significant for buyers.

How has Categorical Inc’s monetary efficiency trended over the previous 5 years?

A evaluate of Categorical Inc’s monetary statements during the last 5 years will present worthwhile insights into the corporate’s development trajectory, profitability, and general monetary well being. This shall be key to evaluating potential funding alternatives.

What’s the present market consensus on Categorical Inc inventory?

Inspecting present market sentiment and professional opinions on Categorical Inc inventory is essential for understanding the general market outlook. These components will help in forming an knowledgeable funding technique.

:max_bytes(150000):strip_icc()/EXPR-Chart-01232020-0c327424d7a742e9a63c6162da8e10f0.png?w=700)