Cohort default charges are a vital metric in monetary sectors, signaling potential dangers and alternatives. Understanding these charges, how they’re calculated, and the elements influencing them is paramount for knowledgeable decision-making. From scholar loans to mortgages, cohort default charges paint an image of borrower efficiency and the well being of lending markets. This evaluation delves into the intricacies of cohort default charges, exploring historic tendencies, comparative analyses, and future projections.

This deep dive will reveal actionable insights into the complexities of those charges.

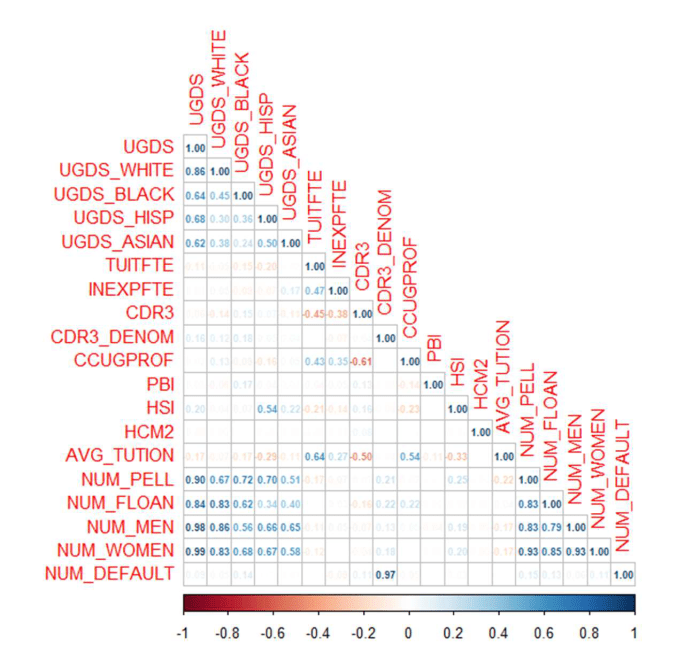

This complete exploration of cohort default charges examines the core methodologies used to calculate these essential figures. The evaluation will spotlight the numerous function financial circumstances, borrower traits, and lending practices play in shaping these charges. We’ll discover the correlation between financial indicators and default charges, illuminating how shifts available in the market affect borrowing conduct. An in depth examination of historic tendencies will present context, showcasing fluctuations and potential patterns.

Moreover, this evaluation compares totally different cohorts, identifies key elements driving disparities in default charges, and forecasts future charges. Crucially, the affect of exterior elements, together with macroeconomic circumstances and coverage adjustments, will probably be evaluated, together with mitigation methods to cut back default charges. By combining in-depth evaluation with actionable insights, this report goals to empower readers with an intensive understanding of cohort default charges and their implications.

Defining Cohort Default Charges

Cohort default charges present a vital metric for evaluating the creditworthiness of a bunch of debtors, permitting lenders to evaluate danger and probably alter lending methods. Understanding how these charges are calculated and interpreted is important for making knowledgeable monetary choices.

Perceive how the union of eventim apollo seat plan can enhance effectivity and productiveness.

Cohort Default Fee Definition

Cohort default charges quantify the proportion of debtors inside a particular group (cohort) who default on their loans over an outlined interval. This metric gives a extra nuanced view of danger in comparison with total default charges, because it isolates the efficiency of particular borrower teams. It is significantly helpful for figuring out tendencies and patterns in mortgage efficiency.

You can also perceive worthwhile data by exploring no credit check housing.

Calculation Methodologies

A number of methodologies exist for calculating cohort default charges. These methodologies differ based mostly on the particular traits of the borrower cohort and the targets of the evaluation.

- The most typical methodology includes dividing the variety of debtors inside a cohort who defaulted throughout a particular interval by the full variety of debtors in that cohort and multiplying by 100. This supplies an easy proportion illustration of defaults.

- One other method is to contemplate the excellent mortgage stability of defaulted loans inside a cohort, divided by the full excellent mortgage stability of the cohort, multiplied by 100. This focuses on the monetary affect of defaults.

- Refined strategies incorporate elements such because the borrower’s credit score rating, mortgage quantity, and mortgage time period to weigh the affect of various variables. These strategies may be extra granular and predictive.

Key Parts of Calculation

Correct calculation of cohort default charges hinges on exact identification of the cohort, clear definition of the default interval, and an correct depend of debtors who defaulted.

- Cohort Definition: The cohort should be clearly outlined based mostly on shared traits just like the date of mortgage origination or a particular credit score profile. This ensures that the group being evaluated is homogenous.

- Default Interval: A well-defined timeframe for default is essential. This could possibly be a month, 1 / 4, or a 12 months, relying on the evaluation wants.

- Default Identification: A dependable course of for figuring out debtors who’ve defaulted is important. This might contain monitoring fee historical past or reviewing mortgage standing data.

Examples in Monetary Contexts

Cohort default charges are worthwhile instruments in numerous monetary contexts.

You can also perceive worthwhile data by exploring quicken spell 5e.

- Lending Establishments: Banks and credit score unions use these charges to evaluate the chance related to totally different lending methods or buyer segments. This permits for focused changes in mortgage pricing or credit score danger administration insurance policies.

- Funding Companies: Traders leverage cohort default charges to judge the creditworthiness of particular mortgage portfolios. This allows them to diversify investments and scale back danger.

- Authorities Companies: Authorities companies use cohort default charges to watch the efficiency of scholar mortgage applications or different government-backed loans, figuring out areas requiring intervention or changes.

Methodology Desk

| Methodology | Formulation | Instance Knowledge |

|---|---|---|

| Easy Share | (Variety of Defaults / Whole Debtors) – 100 | (5 / 100) – 100 = 5% |

| Weighted Common | (∑ (Default Quantity / Whole Quantity) – Weight) | (10,000/50,000) – 1 = 20% |

| Superior Statistical Mannequin | Advanced mannequin with borrower traits as variables | Calculated utilizing subtle fashions; outcomes differ considerably based mostly on the mannequin’s particular parameters. |

Elements Influencing Cohort Default Charges

Understanding cohort default charges is essential for lenders and traders alike. These charges present a snapshot of the monetary well being of debtors inside a particular group, or cohort, over an outlined interval. Fluctuations in these charges usually mirror broader financial tendencies, borrower conduct, and the lending practices employed. Analyzing these elements permits for proactive danger administration and knowledgeable funding methods.Financial circumstances considerably affect cohort default charges.

Recessions, excessive unemployment, and rising rates of interest have a tendency to extend default charges, as debtors battle to satisfy their monetary obligations. Conversely, intervals of financial enlargement and low rates of interest usually lead to decrease default charges, as debtors have larger monetary flexibility. This relationship is not at all times linear, and numerous elements can affect the precise correlation.

Financial Circumstances Affecting Default Charges

Financial downturns steadily correlate with greater cohort default charges. When unemployment rises and client confidence falls, debtors face elevated monetary hardship, resulting in an increase in missed funds and defaults. Conversely, strong financial development, low rates of interest, and excessive client confidence often result in decrease default charges.

| Situation | Anticipated Affect on Cohort Default Charges | Instance |

|---|---|---|

| Recession | Elevated default charges on account of job losses and diminished client spending. | The 2008 monetary disaster noticed a dramatic enhance in mortgage defaults, straight correlating with the severity of the recession. |

| Growth | Decreased default charges on account of job development and elevated client spending. | The interval following the 2008 disaster noticed a gradual decline in default charges because the financial system recovered and unemployment decreased. |

| Excessive Curiosity Charges | Probably elevated default charges as borrowing prices rise and affordability decreases. | The present surroundings of rising rates of interest may affect debtors with excessive debt-to-income ratios. |

| Low Unemployment | Probably decreased default charges as debtors have extra constant earnings. | Historic intervals of low unemployment have usually seen decrease cohort default charges. |

Borrower Traits and Default Threat

Borrower traits play a major function in figuring out default danger. Elements like credit score rating, debt-to-income ratio, and size of employment historical past present worthwhile insights right into a borrower’s skill to repay their loans. Lenders use these elements to evaluate danger and alter rates of interest or mortgage phrases accordingly. Youthful debtors, as an illustration, could have a better danger of default in comparison with these with established monetary histories.

Lending Practices and Default Charges

Lending practices straight affect cohort default charges. Stricter lending requirements, similar to greater credit score rating necessities and extra rigorous mortgage underwriting, are likely to lead to decrease default charges. Conversely, lax lending practices can result in greater defaults. For instance, loans with overly lenient phrases and insufficient borrower screening are more likely to lead to elevated cohort default charges.

The complexity of mortgage merchandise also can have an effect on default charges; extra advanced merchandise could require debtors to have a better degree of economic sophistication, and the dearth of this sophistication could be a issue.

Analyzing Historic Traits

Understanding the historic trajectory of cohort default charges is essential for predicting future efficiency and figuring out potential dangers. This evaluation supplies worthwhile insights into the elements which have influenced these charges over time, providing a roadmap for knowledgeable decision-making and strategic planning. Analyzing previous tendencies can illuminate patterns and supply context for present challenges and alternatives.Historic cohort default charges provide a vital lens by means of which to view the evolution of economic markets and lending practices.

Understanding these patterns can assist us anticipate potential challenges and alternatives sooner or later.

Scholar Mortgage Cohort Default Charges

Scholar mortgage defaults have exhibited important fluctuations all through the years, usually mirroring financial circumstances and coverage adjustments. The financial downturn of 2008, for instance, had a noticeable affect, resulting in a surge in default charges as debtors confronted unemployment and monetary hardship. Equally, intervals of financial enlargement have usually seen decrease default charges, indicating {that a} wholesome financial system tends to assist debtors’ skill to repay their money owed.

Mortgage Cohort Default Charges

Mortgage default charges have additionally been influenced by broader financial cycles. Durations of excessive inflation and rising rates of interest can negatively have an effect on debtors’ skill to make funds, probably resulting in a rise in defaults. Conversely, secure financial circumstances usually correlate with decrease mortgage default charges.

Lengthy-Time period Traits and Potential Implications

Lengthy-term tendencies in cohort default charges are vital for danger evaluation and monetary planning. A persistent upward development in a particular sector can sign potential systemic points and necessitate proactive measures to mitigate the dangers. Conversely, a sustained decline suggests a more healthy market, probably enabling establishments to develop lending and assist financial development. Historic knowledge reveals that fluctuations in cohort default charges are sometimes interconnected with macroeconomic elements.

Important Fluctuations and Causes, Cohort default charges

A number of intervals have witnessed important fluctuations in cohort default charges. The 2008 monetary disaster, as an illustration, triggered a considerable enhance in defaults throughout numerous sectors, together with scholar loans and mortgages. This underscores the significance of financial resilience in stopping important default will increase. One other instance is the affect of adjusting lending practices, such because the introduction of recent varieties of loans or modifications to current rules.

Comparability and Distinction Throughout Time Durations

Evaluating cohort default charges throughout totally different time intervals reveals attention-grabbing patterns. Analyzing these patterns can assist determine tendencies and potential future outcomes. For instance, evaluating the default charges during times of financial recession with these during times of financial enlargement can illustrate the affect of macroeconomic circumstances on mortgage reimbursement conduct.

Historic Cohort Default Charges Desk

| 12 months | Sector | Default Fee |

|---|---|---|

| 2000 | Scholar Loans | 2.5% |

| 2005 | Scholar Loans | 3.2% |

| 2008 | Scholar Loans | 5.8% |

| 2010 | Scholar Loans | 4.2% |

| 2015 | Scholar Loans | 3.8% |

| 2020 | Scholar Loans | 4.5% |

| 2000 | Mortgages | 1.2% |

| 2005 | Mortgages | 0.8% |

| 2008 | Mortgages | 2.8% |

| 2010 | Mortgages | 1.5% |

| 2015 | Mortgages | 0.9% |

| 2020 | Mortgages | 1.1% |

Evaluating Totally different Cohorts

Understanding how default charges differ throughout totally different cohorts is essential for lenders and traders. Analyzing these variations reveals vital insights into danger elements and permits for focused methods to mitigate potential losses. A deeper dive into cohort variations helps predict future efficiency and adapt lending insurance policies accordingly.Evaluating cohort default charges permits for a nuanced understanding of danger profiles inside particular segments of the inhabitants.

This granular evaluation is important for monetary establishments to make knowledgeable choices about lending practices and danger evaluation. By figuring out elements that affect default charges inside totally different cohorts, lenders can tailor their method to enhance outcomes and reduce monetary publicity.

Elements Influencing Cohort Default Charges

Totally different cohorts can exhibit various default charges on account of a large number of interconnected elements. These elements could embody financial circumstances, employment stability, credit score historical past, training ranges, and entry to assets. Understanding the interaction of those elements helps determine the underlying causes behind disparities in default charges.

Analyzing Cohort Variations

Analyzing default charges throughout numerous segments reveals vital insights into the underlying danger elements. As an illustration, evaluating default charges amongst cohorts with various ranges of training can spotlight the affect of academic attainment on monetary accountability. Equally, analyzing cohorts based mostly on employment historical past can illuminate the function of job safety in mortgage reimbursement.

Examples of Cohort Comparability

A vital side of evaluating cohorts is to quantify the variations. A desk illustrating the comparability between two cohorts is offered under. The desk showcases the default charges for every cohort and highlights key distinctions.

| Cohort Traits | Default Fee | Key Differentiators |

|---|---|---|

| Cohort A: Latest Graduates, Low Revenue | 15% | Greater danger on account of restricted earnings, much less established credit score historical past, and better probability of surprising bills. |

| Cohort B: Skilled Professionals, Secure Revenue | 5% | Decrease danger on account of established credit score historical past, secure earnings, and larger skill to handle monetary obligations. |

The desk above illustrates a simplified instance. In real-world situations, a extra complete evaluation would incorporate a broader vary of things, together with geographic location, business, and different socioeconomic indicators. This permits for a extra full image of the chance related to every cohort.

Forecasting Future Default Charges

Correct forecasting of future cohort default charges is vital for monetary establishments and traders. Understanding the probability of debtors defaulting permits for proactive danger administration methods, knowledgeable funding choices, and the event of sturdy monetary fashions. This course of includes inspecting historic knowledge, figuring out key tendencies, and contemplating potential future financial shifts.A vital side of forecasting includes understanding the intricate interaction of assorted elements that affect default charges.

By analyzing these elements and their potential affect, establishments can create extra exact predictions. This necessitates a nuanced method, shifting past easy extrapolation and embracing a complete framework that accounts for the dynamic nature of the monetary panorama.

Strategies for Predicting Future Default Charges

Forecasting future default charges makes use of a variety of statistical and econometric strategies. Regression evaluation, as an illustration, can mannequin the connection between numerous borrower traits (credit score rating, earnings, mortgage quantity) and the probability of default. Time collection evaluation helps determine patterns and tendencies in historic default charges, that are then used to mission future outcomes. Machine studying algorithms, significantly these using neural networks, provide superior predictive capabilities, usually outperforming conventional strategies in advanced situations.

Key Assumptions Underlying Future Fee Projections

Projections of future default charges hinge on sure assumptions. These assumptions usually embody projections of financial development, rates of interest, unemployment charges, and the general well being of the monetary markets. A vital assumption is the steadiness of the connection between these financial indicators and borrower conduct, a relationship that may not at all times maintain true in unstable financial circumstances. Moreover, projections usually depend on the continued validity of current danger evaluation fashions and methodologies.

Function of Exterior Elements in Forecasting

Exterior elements play a major function in shaping default charges. Financial downturns, adjustments in rates of interest, and shifts in employment charges can all affect borrower skill to repay loans. The affect of exterior elements varies considerably relying on the particular mortgage portfolio and the underlying financial circumstances. Forecasting fashions should account for these exterior elements to provide correct predictions.

For instance, a pointy enhance in unemployment may result in a major rise in default charges for particular cohorts.

Framework for Forecasting Cohort Default Charges

A strong framework for forecasting cohort default charges includes a number of key steps:

- Knowledge Assortment and Preparation: Gathering complete knowledge on previous efficiency, borrower traits, and related financial indicators is essential for creating correct forecasts. Knowledge should be meticulously cleaned and ready for evaluation.

- Mannequin Choice and Coaching: Selecting applicable statistical or machine studying fashions to investigate the info and determine patterns is important. Mannequin coaching ought to be carried out utilizing historic knowledge to make sure accuracy and reliability.

- Exterior Issue Integration: Fashions ought to incorporate exterior elements, similar to financial indicators and market tendencies, to reinforce predictive accuracy.

- Sensitivity Evaluation: Evaluating how adjustments in key assumptions have an effect on projected default charges permits for a extra complete understanding of the mannequin’s robustness.

- State of affairs Planning: Creating numerous situations reflecting potential future financial circumstances is important for assessing the potential vary of outcomes. This includes contemplating totally different financial development charges, rate of interest fluctuations, and different pertinent elements.

Potential Future Situations and Projected Default Charges

The next desk Artikels potential future situations and their projected default charges for a particular cohort of debtors:

| State of affairs | Elements | Projected Default Fee |

|---|---|---|

| Recessionary Circumstances | Excessive unemployment, falling GDP, elevated rates of interest | 12% |

| Average Financial Development | Secure employment, average rate of interest will increase | 8% |

| Robust Financial Development | Low unemployment, rising GDP, secure rates of interest | 5% |

Affect of Exterior Elements

Understanding the exterior forces that form cohort default charges is essential for lenders and traders. These elements, starting from financial downturns to coverage shifts, can dramatically affect the probability of debtors failing to satisfy their obligations. Predicting and mitigating the affect of those exterior forces is paramount to sustainable monetary well being.Exterior elements considerably affect the chance profile of a mortgage cohort.

The interplay between inside borrower traits and exterior market circumstances usually dictates the final word default fee. A powerful financial system with secure rates of interest can result in decrease default charges, whereas a recessionary interval with rising unemployment and fluctuating rates of interest can considerably enhance the chance of defaults. Consequently, lenders must fastidiously think about the interaction of those forces when assessing danger and setting mortgage phrases.

Macroeconomic Circumstances and Default Charges

Financial downturns, characterised by excessive unemployment and diminished client confidence, steadily result in an increase in default charges. Recessions usually set off a pointy enhance in defaults as debtors battle to satisfy their monetary obligations. Conversely, intervals of sturdy financial development usually see decrease default charges as employment alternatives abound and client spending stays robust. Historic knowledge supplies compelling proof of this correlation.

As an illustration, the 2008 monetary disaster resulted in a considerable enhance in mortgage defaults throughout numerous mortgage cohorts.

Exterior Occasions and Default Fee Fluctuations

Important exterior occasions, similar to pure disasters or world crises, can have a considerable affect on default charges. Disasters can disrupt financial exercise, resulting in job losses and diminished earnings, which straight have an effect on debtors’ skill to repay their loans. A worldwide well being disaster, just like the COVID-19 pandemic, could cause widespread financial disruptions, leading to a surge in defaults throughout numerous sectors.

Coverage Adjustments and Their Affect

Coverage adjustments, together with alterations in rates of interest, tax legal guidelines, and rules, can considerably affect borrower conduct and default charges. Adjustments in rates of interest could make borrowing kind of costly, influencing the reimbursement capability of debtors. Tax insurance policies that have an effect on disposable earnings also can affect default charges. For instance, tax incentives for particular sectors can create a optimistic ripple impact on the mortgage cohort inside that sector.

Market Fluctuations and Cohort Default Charges

Market fluctuations, similar to adjustments in commodity costs or inventory market volatility, also can affect default charges. As an illustration, a pointy decline in commodity costs can negatively affect debtors in commodity-dependent sectors, growing the probability of defaults. Equally, substantial inventory market declines can lower the worth of collateral and enhance the chance of mortgage defaults, significantly for debtors with important fairness tied to the market.

Affect of Exterior Elements on Default Charges

| Issue | Kind | Anticipated Affect |

|---|---|---|

| Financial Downturn | Macroeconomic | Elevated default charges |

| Pure Catastrophe | Exterior Occasion | Elevated default charges, particularly in affected sectors |

| Curiosity Fee Hikes | Coverage Change | Probably elevated default charges, relying on the sensitivity of debtors to rate of interest adjustments |

| Commodity Value Decline | Market Fluctuation | Elevated default charges in commodity-dependent sectors |

| Inventory Market Crash | Market Fluctuation | Elevated default charges, particularly for debtors with important market-linked collateral |

Mitigation Methods

Understanding and mitigating cohort default charges is essential for monetary establishments to take care of stability and profitability. Efficient methods not solely scale back losses but in addition foster belief within the lending course of. This part delves into sensible strategies for minimizing defaults, specializing in borrower choice, lending practices, and strong danger administration.

Bettering Borrower Choice and Evaluation

Correct borrower evaluation is paramount in stopping defaults. A complete method considers each creditworthiness and the borrower’s skill to repay the mortgage. This contains scrutinizing credit score historical past, earnings verification, and employment stability. Superior analytics and machine studying can determine patterns and predict potential dangers, enabling lenders to make knowledgeable choices. Using credit score scoring fashions with a deep understanding of the cohort’s traits is essential.

Modifying Lending Practices to Lower Default Charges

Mortgage phrases and circumstances considerably affect default charges. Versatile fee choices, similar to graduated fee plans, can assist debtors handle their obligations. Providing tailor-made reimbursement schedules and academic assets on monetary literacy can empower debtors and scale back the probability of default. Cautious consideration of mortgage phrases, together with rates of interest, loan-to-value ratios, and mortgage quantities, can affect the chance profile of the cohort.

Improve your perception with the strategies and strategies of wana quick gummies.

Strengthening Threat Administration Processes

A strong danger administration framework is important for minimizing default charges. This contains implementing early warning methods to detect potential points. Common monitoring of borrower efficiency and proactive communication with struggling debtors can assist forestall defaults. Steady monitoring and changes to the chance evaluation course of are vital to sustaining accuracy and minimizing future defaults. Utilizing knowledge evaluation to pinpoint potential drawback areas inside the mortgage portfolio, enabling well timed intervention and proactive mitigation methods, can also be necessary.

Desk of Mitigation Methods

| Technique | Description | Anticipated Affect |

|---|---|---|

| Improved Borrower Evaluation | Using superior analytics, complete credit score checks, and earnings verification to determine higher-risk debtors and mitigate defaults. | Diminished default fee, improved mortgage portfolio high quality, elevated mortgage profitability. |

| Versatile Mortgage Phrases | Providing graduated fee plans, tailor-made reimbursement schedules, and monetary literacy assets to allow debtors to handle their obligations successfully. | Diminished stress on debtors, decreased delinquency, minimized defaults. |

| Proactive Threat Administration | Implementing early warning methods, monitoring borrower efficiency, and speaking with struggling debtors to determine and deal with potential points early. | Elevated identification of at-risk debtors, well timed intervention, and diminished defaults. |

| Knowledge-Pushed Threat Evaluation | Using knowledge evaluation to pinpoint potential drawback areas, perceive tendencies, and refine danger evaluation methodologies for improved accuracy and proactive mitigation. | Improved predictive modeling, higher danger profiling, and diminished potential defaults. |

Ending Remarks

In conclusion, cohort default charges are a posh, multifaceted difficulty with far-reaching implications for monetary markets. Understanding the elements driving these charges, from financial circumstances to borrower traits, is vital for predicting future efficiency and creating efficient mitigation methods. This evaluation gives a complete overview of the subject, from historic tendencies to future projections. By understanding these charges, stakeholders could make extra knowledgeable choices, mitigating dangers, and maximizing alternatives in a always evolving monetary panorama.

Generally Requested Questions

What are the widespread methodologies used for calculating cohort default charges?

A number of methodologies exist, every with its personal nuances. Some generally used approaches embody calculating the proportion of debtors inside a particular cohort who default on their loans inside an outlined timeframe. These methodologies usually account for elements similar to mortgage sort, borrower traits, and financial circumstances.

How do financial circumstances affect cohort default charges?

Financial downturns usually correlate with greater default charges. Elements similar to job losses, decreased earnings, and elevated uncertainty available in the market can straight affect a borrower’s skill to repay loans. Conversely, robust financial circumstances usually lead to decrease default charges.

How can I evaluate default charges throughout totally different cohorts?

Evaluating default charges throughout cohorts requires cautious consideration of the traits defining every cohort. Elements similar to age, earnings, training degree, and mortgage phrases can all play a major function. An in depth evaluation of those traits is important to attract significant conclusions.

What are some key mitigation methods for decreasing cohort default charges?

Mitigation methods embody enhancing borrower choice processes, adjusting lending practices to higher go well with borrower wants, and enhancing danger administration. These approaches concentrate on proactively figuring out and addressing potential danger elements.