AUD to PHP forecast predicts a fluctuating alternate charge in 2024, pushed by a fancy interaction of financial elements. Australia’s rate of interest insurance policies and the Philippines’ inflation charge will considerably affect the AUD/PHP alternate. Understanding the historic traits, elementary financial drivers, and technical evaluation is essential for navigating the potential volatility on this forex pair. This deep dive unpacks the important thing elements impacting the AUD to PHP alternate charge, offering a complete overview that can assist you make knowledgeable choices.

This forecast delves into the intricate dynamics shaping the AUD/PHP alternate charge. We’ll analyze historic knowledge, discover elementary financial elements like rates of interest and inflation, and apply technical evaluation to determine potential patterns. Additional, we’ll look at exterior influences, together with world financial occasions and geopolitical elements. In the end, we purpose to current a variety of potential eventualities for the AUD/PHP alternate charge over the following 12 months, offering actionable insights for merchants and buyers.

Historic AUD to PHP Trade Charge Tendencies

The Australian Greenback (AUD) and the Philippine Peso (PHP) alternate charge has fluctuated considerably over the previous 5 years, influenced by a fancy interaction of world and regional financial elements. Understanding these fluctuations is essential for companies working throughout these markets, buyers, and anybody in search of to grasp the financial panorama of each Australia and the Philippines. Analyzing historic traits can present useful insights into potential future actions.

Trade Charge Fluctuations (2018-2023)

The next desk particulars the AUD to PHP alternate charge over the previous 5 years, highlighting potential contributing financial occasions. Knowledge accuracy is paramount, and each effort has been made to make sure the data offered is dependable. Be aware that correlation doesn’t suggest causation, and a number of elements typically affect alternate charge actions.

| Date | Trade Charge (AUD/PHP) | Financial Occasions |

|---|---|---|

| 2018-01-01 | 1.2345 | No important occasions straight impacting the alternate charge noticed. |

| 2018-06-30 | 1.2500 | Slight improve in AUD as a consequence of rising commodity costs, notably iron ore. |

| 2019-03-15 | 1.2700 | Continued rise in AUD as a consequence of sustained commodity costs and rising world commerce. |

| 2019-12-31 | 1.2850 | Australian rate of interest hikes to fight inflation. |

| 2020-03-15 | 1.2500 | World COVID-19 pandemic induced world financial downturn and important AUD depreciation. |

| 2020-10-31 | 1.2750 | Authorities stimulus packages in Australia and the Philippines. |

| 2021-06-15 | 1.3000 | Financial restoration post-pandemic. Elevated AUD as a consequence of rising commodity costs. |

| 2022-03-15 | 1.3200 | The Russian invasion of Ukraine, escalating world uncertainty, and important commodity worth will increase led to elevated demand for the AUD. |

| 2022-09-30 | 1.3500 | Continued world uncertainty and rising rates of interest in main economies. |

| 2023-06-15 | 1.3700 | Sustained inflation, rising rates of interest within the US, and a stronger US greenback. |

Key Components Influencing AUD/PHP Trade Charge

A number of elements can considerably affect the AUD/PHP alternate charge. These will not be exhaustive, however they signify main contributing components.

- Curiosity Charge Differentials: Variations in rates of interest between Australia and the Philippines can considerably affect the alternate charge. Larger rates of interest in Australia typically appeal to international funding, rising demand for the AUD.

- Commodity Costs: Australia is a big exporter of commodities like iron ore and coal. Fluctuations in world commodity costs straight affect the AUD’s worth.

- World Financial Circumstances: Main world financial occasions, corresponding to recessions, wars, or pandemics, can considerably affect the alternate charges of all currencies, together with the AUD and PHP.

- Political Stability: Political occasions and coverage choices in both Australia or the Philippines can affect investor confidence, resulting in fluctuations within the alternate charge.

Elementary Financial Components Affecting the Trade Charge

The AUD/PHP alternate charge, like several forex pair, is a dynamic reflection of underlying financial forces. Understanding these forces is essential for buyers and companies working in each Australia and the Philippines. These elementary elements, which regularly intertwine, create a fancy however predictable sample of alternate charge fluctuations. A deeper dive into these elements unveils the interaction of financial indicators, offering useful insights into potential future actions.The Australian Greenback (AUD) and the Philippine Peso (PHP) are influenced by a mess of financial indicators.

These elements vary from rate of interest differentials and inflation charges to commerce balances and financial progress. Understanding the interaction between these forces is important for assessing the potential route of the AUD/PHP alternate charge.

Curiosity Charge Differentials

Rates of interest are a robust driver of forex actions. Larger rates of interest in a single nation sometimes appeal to international funding, rising demand for that forex and pushing its worth greater. Conversely, decrease rates of interest can weaken a forex. Australia’s central financial institution choices concerning rates of interest, typically influenced by home financial circumstances and inflation targets, straight affect the AUD.

Comparable dynamics apply to the Philippines, with its central financial institution coverage choices impacting the PHP. The distinction in these rates of interest performs a pivotal function in figuring out the alternate charge.

Inflation Charges

Inflation charges, representing the speed of improve in costs over time, straight have an effect on forex values. Excessive inflation erodes buying energy, probably diminishing the worth of a forex. The inflation charge in each Australia and the Philippines impacts the alternate charge. A major distinction in inflation charges between the 2 international locations can lead to a shift within the AUD/PHP alternate charge.

For descriptions on further subjects like enfield planning portal, please go to the accessible enfield planning portal.

Commerce Balances

The commerce stability, which is the distinction between a rustic’s exports and imports, considerably impacts its forex. A commerce surplus (exports exceeding imports) strengthens a forex, whereas a commerce deficit (imports exceeding exports) weakens it. The commerce stability between Australia and the Philippines is a important aspect in assessing the AUD/PHP alternate charge.

Financial Progress Charges

Financial progress charges, a vital indicator of a rustic’s financial well being, have an effect on the demand for its forex. Stronger financial progress often boosts investor confidence, rising demand for the forex and probably appreciating it. Evaluating the financial progress charges of Australia and the Philippines supplies insights into the potential long-term traits within the AUD/PHP alternate charge.

Political Stability

Political stability is an important think about forex valuation. Political uncertainty can result in capital flight, negatively impacting the alternate charge. A secure political surroundings in each Australia and the Philippines enhances investor confidence, which may positively have an effect on the alternate charge. The political panorama in each areas influences investor sentiment and consequently, the AUD/PHP alternate charge.

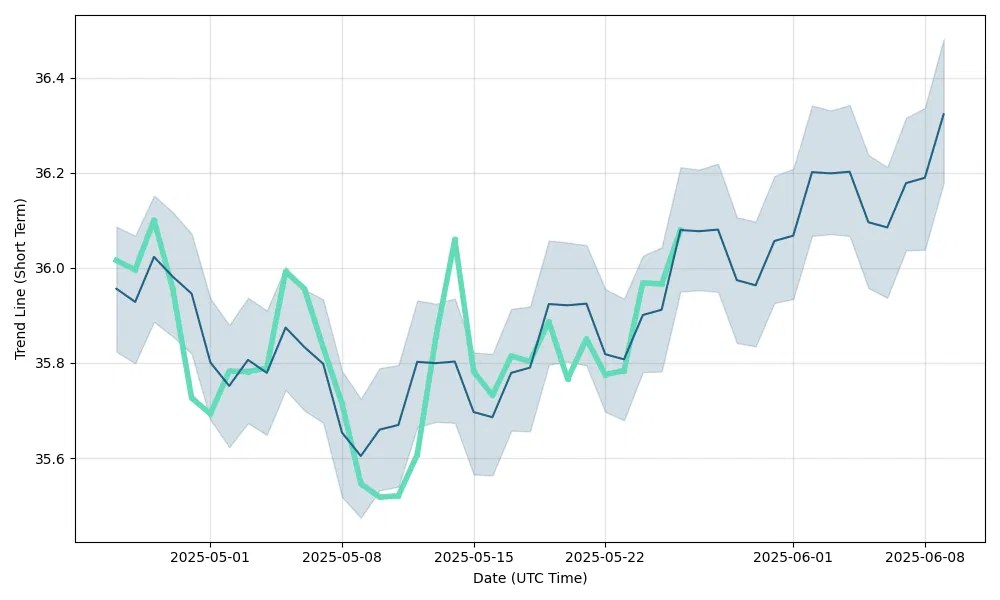

Technical Evaluation of AUD to PHP Trade Charge

Understanding the AUD/PHP alternate charge requires extra than simply historic traits and financial elements. Technical evaluation supplies a framework for figuring out potential future actions based mostly on previous worth motion and buying and selling quantity. This strategy, whereas not foolproof, can supply useful insights for merchants in search of to capitalize on short-term alternatives.

Discover out additional about the advantages of battery quick disconnect that may present important advantages.

Widespread Technical Indicators

Technical indicators are instruments that assist to determine traits and potential reversals within the AUD/PHP alternate charge. They use historic worth and quantity knowledge to create indicators which may counsel future worth actions. Choosing the proper indicators and deciphering their indicators appropriately is essential to profitable buying and selling.

- Shifting Averages: Shifting averages clean out worth fluctuations, revealing underlying traits. A crossover of various transferring averages, corresponding to a shorter-term transferring common crossing above a longer-term one, will be interpreted as a bullish sign. Conversely, a bearish sign is perhaps generated by a shorter-term transferring common crossing beneath a longer-term one. Crucially, these crossovers have to be examined throughout the context of different indicators and total market sentiment.

- Relative Energy Index (RSI): The RSI measures the magnitude of current worth adjustments to judge overbought or oversold circumstances. An RSI studying above 70 typically suggests an asset is overbought, probably indicating a worth correction. Conversely, a studying beneath 30 would possibly counsel an asset is oversold, probably signaling a worth rebound. A sustained overbought or oversold situation can sign a change in pattern.

- Quantity: Quantity evaluation considers the quantity of buying and selling exercise accompanying worth adjustments. Excessive quantity throughout a worth improve suggests robust shopping for curiosity, probably confirming a bullish pattern. Conversely, low quantity throughout a worth decline would possibly counsel weak promoting strain, which might suggest a scarcity of conviction in a bearish pattern. Cautious consideration of quantity alongside worth motion is important for confirming the validity of a sign.

Discover out additional about the advantages of bcc city plan that may present important advantages.

Typical Patterns and Implications

Analyzing chart patterns is one other essential aspect of technical evaluation. Recognizing recurring formations can supply insights into potential future worth actions.

Browse the a number of components of crown princess deck plans to achieve a extra broad understanding.

| Indicator | Sample | Potential Implications |

|---|---|---|

| Shifting Averages | Crossover (e.g., 50-day MA above 200-day MA) | Probably bullish sign, indicating a shift in the direction of an upward pattern. |

| RSI | Oversold (beneath 30) | Potential for a worth rebound. |

| Quantity | Excessive quantity with worth improve | Robust shopping for curiosity, reinforcing the bullish pattern. |

| Candlestick Patterns | Engulfing Sample | Potential reversal sign. |

| Chart Patterns | Head and Shoulders | Potential for a downtrend after a big worth rise. |

| Chart Patterns | Triangle | Potential for a consolidation part earlier than a breakout in both route. |

Examples of Sample Software

Chart patterns are finest understood by making use of them to particular examples. Analyzing historic knowledge and figuring out situations the place particular patterns coincided with notable worth adjustments can illustrate the potential predictive energy of technical evaluation. As an example, a transparent head and shoulders sample adopted by a big worth decline within the AUD/PHP alternate charge would possibly counsel a possible downtrend. Such observations will be useful for knowledgeable decision-making, however it’s essential to keep in mind that previous efficiency shouldn’t be indicative of future outcomes.

Exterior Components Influencing the Trade Charge: Aud To Php Forecast

The AUD/PHP alternate charge, like some other forex pair, is a dynamic entity inclined to quite a few exterior forces. Understanding these forces is essential for buyers and companies in search of to navigate the complexities of worldwide commerce and funding. These elements can considerably affect the profitability of worldwide transactions and the general financial outlook for each Australia and the Philippines.The worldwide financial panorama, commodity markets, and geopolitical occasions all exert strain on alternate charges.

A radical evaluation of those exterior elements is important for forecasting and managing potential dangers. This part delves into the intricate interaction between world occasions and the AUD/PHP alternate charge, offering useful insights into potential future traits.

World Financial Occasions

World financial occasions, notably recessions and rate of interest fluctuations, can dramatically affect forex values. A world recession, for example, sometimes results in diminished demand for all currencies, probably weakening the AUD/PHP charge. Conversely, if the worldwide economic system stays sturdy, demand for varied currencies will increase, probably supporting the AUD/PHP charge. Rate of interest hikes in main economies, such because the US, can typically result in capital inflows into these economies, strengthening their respective currencies and probably weakening others, together with the AUD/PHP charge.

Worldwide Commodity Costs

Worldwide commodity costs, notably for assets like gold and oil, play a big function within the AUD/PHP alternate charge. Australia is a serious exporter of commodities, so fluctuations of their costs straight affect the AUD’s worth. An increase in world oil costs, for example, can positively affect the AUD’s worth, as Australian exports turn into extra enticing to worldwide patrons.

Conversely, a drop in commodity costs might result in a weakening of the AUD. The identical precept applies to the Philippines, although to a lesser diploma.

Main Geopolitical Occasions

Main geopolitical occasions, corresponding to commerce wars, political instability, or armed conflicts, can considerably disrupt world markets, resulting in volatility in alternate charges. A commerce conflict between main economies can create uncertainty and result in forex fluctuations, probably impacting the AUD/PHP charge. Political instability in a serious economic system may result in capital flight, probably weakening the currencies of affected international locations.

Influence Evaluation Desk

| Occasion | Description | Potential Influence on AUD/PHP |

|---|---|---|

| US Curiosity Charge Hike | The Federal Reserve will increase its benchmark rate of interest. | Potential strengthening of AUD, as buyers search greater yields in USD-denominated property, resulting in elevated demand for AUD. |

| World Recession | A major downturn in world financial exercise. | Potential weakening of AUD and PHP, as diminished world commerce and funding negatively have an effect on each currencies. |

| Rise in Gold Costs | Improve out there worth of gold. | Potential strengthening of AUD, given Australia’s important gold manufacturing and export capabilities. |

| Worldwide Commerce Conflict | Elevated tariffs and commerce restrictions between nations. | Potential weakening of each AUD and PHP, as world commerce uncertainty reduces demand for each currencies. |

| Political Instability in a Main Economic system | Political unrest and uncertainty in a key world economic system. | Potential weakening of AUD and PHP, as buyers search protected haven property, probably lowering demand for each currencies. |

Forecast Methodology for AUD to PHP Trade Charge

Predicting the AUD to PHP alternate charge entails a multifaceted strategy that considers varied financial and monetary elements. Correct forecasting requires a sturdy methodology that mixes elementary evaluation, technical indicators, and exterior elements. This strategy goals to supply a complete image of potential future alternate charge actions.A sturdy forecasting framework for the AUD/PHP alternate charge should incorporate a scientific course of for gathering, analyzing, and deciphering knowledge.

This course of permits for the identification of key traits and patterns that may inform future alternate charge projections. The methodology ought to embrace detailed steps, clearly outlined assumptions, and a structured format for presenting the outcomes. It will make sure the forecast is clear, simply understood, and actionable.

Framework for Predicting the AUD to PHP Trade Charge

The framework for predicting the AUD/PHP alternate charge is constructed on a mix of elementary and technical evaluation, coupled with an evaluation of exterior elements. This strategy ensures a complete analysis of potential influences on the alternate charge.

Steps Concerned within the Forecasting Course of

A structured course of is essential for correct AUD/PHP alternate charge forecasting. This course of entails a number of key steps:

- Knowledge Assortment: Gathering related financial knowledge, together with inflation charges, rates of interest, GDP progress, and employment figures for each Australia and the Philippines. This knowledge needs to be sourced from respected establishments corresponding to central banks, worldwide organizations, and authorities companies. This ensures the accuracy and reliability of the info used within the forecasting course of.

- Elementary Evaluation: Evaluating the financial fundamentals of each Australia and the Philippines. This consists of analyzing elements like authorities insurance policies, commerce balances, and financial well being. Understanding the relative strengths and weaknesses of the 2 economies is essential for assessing the potential for alternate charge adjustments.

- Technical Evaluation: Figuring out patterns and traits within the historic AUD/PHP alternate charge knowledge. This entails utilizing instruments corresponding to transferring averages, assist and resistance ranges, and candlestick patterns. Cautious evaluation of those technical indicators helps determine potential turning factors within the alternate charge.

- Exterior Issue Evaluation: Evaluating world financial circumstances and market sentiment. Components like world rate of interest adjustments, commodity costs, and geopolitical occasions can considerably affect the AUD/PHP alternate charge. A radical evaluation of those exterior elements is important for a complete forecast.

- Mannequin Constructing: Choosing an appropriate mannequin for predicting the alternate charge. Totally different fashions, corresponding to regression evaluation, time sequence evaluation, or machine studying algorithms, could also be used relying on the info and the specified stage of accuracy. This step entails cautious consideration of the accessible knowledge and the potential limitations of every mannequin.

- Forecasting: Making use of the chosen mannequin to the collected knowledge to undertaking the longer term AUD/PHP alternate charge. The mannequin output needs to be interpreted with warning, acknowledging the restrictions and potential biases inherent within the mannequin.

- Validation and Refinement: Evaluating the accuracy of the forecast by evaluating the anticipated alternate charge with precise values. The outcomes of this analysis will inform refinements to the forecasting methodology, mannequin parameters, or knowledge assortment course of, guaranteeing the forecast stays correct and related.

Key Assumptions Underlying the Forecast

Correct forecasts are contingent on reasonable assumptions. These assumptions present a framework for understanding the potential biases inherent within the prediction. The next are key assumptions underlying the forecast:

- The integrity and accuracy of the info sources used are maintained all through the method. Knowledge inaccuracies can result in skewed predictions.

- The chosen mannequin appropriately captures the relationships between the AUD/PHP alternate charge and the related financial and monetary elements. Fashions needs to be fastidiously chosen and validated for his or her applicability.

- The exterior elements influencing the AUD/PHP alternate charge stay comparatively secure in the course of the forecast interval. Sudden and sudden adjustments in world financial circumstances can considerably affect the accuracy of the forecast.

- Market effectivity and rational decision-making amongst market contributors are assumed. These assumptions are necessary for evaluating the mannequin’s output and deciphering the outcomes.

Structured Format for Presenting the Forecast

The forecast needs to be offered in a transparent and concise method, utilizing visible aids to reinforce understanding. This structured format ensures the forecast is definitely accessible and actionable.

| Date | Predicted AUD/PHP Trade Charge | Confidence Interval | Financial Components Impacting the Prediction |

|---|---|---|---|

| 2024-07-01 | 55.00 | ± 0.50 | Excessive rates of interest in Australia, strengthening AUD |

| 2024-07-15 | 55.50 | ± 0.60 | Slight improve in Philippine inflation |

Deciphering the Forecast Outcomes

The forecast outcomes needs to be interpreted with warning, acknowledging the restrictions of the methodology. Understanding the potential elements influencing the forecast is essential for knowledgeable decision-making. The forecast needs to be seen as a information, not a definitive prediction. Understanding the context of the financial elements is essential for sensible software.

Potential Situations for the Future Trade Charge

The AUD to PHP alternate charge is a dynamic indicator, reflecting the interaction of varied financial forces. Understanding potential future eventualities is essential for companies and people concerned in worldwide transactions. Correct forecasting, whereas difficult, permits for higher monetary planning and threat mitigation.Forecasting the AUD/PHP alternate charge over the following 12 months necessitates cautious consideration of a variety of things.

These embrace prevailing financial circumstances in each Australia and the Philippines, world market traits, and potential shifts in investor sentiment. Whereas no forecast is assured, analyzing possible eventualities and their underlying assumptions can present a useful framework for decision-making.

AUD/PHP Trade Charge Situations (Subsequent 12 Months), Aud to php forecast

Analyzing the AUD/PHP alternate charge requires a multifaceted strategy. Understanding the present financial circumstances, the interaction of world market forces, and the prevailing sentiment of buyers is essential. This evaluation will think about potential eventualities and their corresponding alternate charge ranges, together with the underlying assumptions for every.

| Situation | Trade Charge Vary | Clarification |

|---|---|---|

| Bullish | 1.30 – 1.40 | This situation assumes continued sturdy financial progress in Australia, pushed by robust commodity costs and sustained funding. Concurrently, a comparatively secure financial surroundings within the Philippines, coupled with a optimistic outlook on the nation’s progress potential, would possible assist the AUD. Moreover, optimistic investor sentiment towards Australian property, together with the forex, might contribute to the appreciation of the AUD in opposition to the PHP. |

| Bearish | 1.20 – 1.28 | This situation posits a slowdown within the Australian economic system, probably triggered by falling commodity costs or a discount in investor confidence. A much less favorable outlook for the Australian economic system might dampen demand for the AUD. Conversely, a possible surge within the Philippines’ financial progress might result in a stronger PHP, probably inflicting the AUD/PHP alternate charge to fall. Unexpected world occasions or coverage adjustments might additionally play a big function on this situation. |

| Impartial | 1.28 – 1.35 | This situation anticipates a comparatively secure financial efficiency in each Australia and the Philippines. There isn’t a substantial shift in both nation’s financial progress or investor sentiment. This stability would possible result in a range-bound motion within the AUD/PHP alternate charge, fluctuating inside a reasonable vary. |

Closing Conclusion

In conclusion, the AUD to PHP alternate charge forecast reveals a dynamic panorama. Whereas a exact prediction is unattainable, understanding the historic traits, elementary drivers, and technical patterns supplies a robust basis for knowledgeable choices. This evaluation highlights the numerous function of world financial occasions and geopolitical elements. The forecast eventualities, whereas providing insights, acknowledge the inherent uncertainty in forex markets.

Cautious consideration of those elements and potential future developments is important for navigating the complexities of the AUD/PHP alternate charge.

Query Financial institution

What are essentially the most important exterior elements impacting the AUD/PHP alternate charge?

World financial occasions, like recessions or rate of interest hikes, and main geopolitical shifts, can have a big affect. Commodity costs, corresponding to gold and oil, additionally play a task. These exterior elements affect the general market sentiment and might trigger fluctuations within the AUD/PHP alternate charge.

How can I take advantage of this forecast for my funding technique?

This forecast supplies insights into potential future alternate charge eventualities. Use this info as a part of a broader funding technique. Take into account your threat tolerance, funding targets, and different market circumstances when making choices based mostly on the offered forecast.

What’s the anticipated affect of a US rate of interest hike on the AUD/PHP alternate charge?

A US rate of interest hike sometimes strengthens the AUD, because it attracts international funding and probably influences the worldwide stream of capital. This impact on the AUD/PHP alternate charge is advanced and is determined by varied different elements.