Webull high gainers units the stage for this enthralling narrative, providing readers a glimpse right into a story that’s wealthy intimately and brimming with originality from the outset. We’ll dissect the highest 10 Webull shares which have surged probably the most within the final month, analyzing the elements behind their exceptional performances. From business tendencies to firm bulletins, we’ll uncover the important thing drivers behind these inventory worth will increase and discover the potential dangers and alternatives for buyers.

Get able to dive deep into the world of high-growth shares and uncover the secrets and techniques behind their success.

This in-depth evaluation goes past merely itemizing the highest performers. We’ll delve into the standards used to determine these gainers, together with share enhance and buying and selling quantity. Moreover, we’ll present a complete breakdown of the potential dangers and alternatives related to every of the highest 5 shares. This permits buyers to make knowledgeable selections and perceive the nuances of the market earlier than investing.

Figuring out High Gainers: Webull High Gainers

Market volatility usually presents profitable alternatives for buyers, however navigating the advanced panorama of inventory efficiency calls for a scientific strategy. Understanding which shares are experiencing important positive aspects is essential for knowledgeable decision-making. This evaluation focuses on figuring out high gainers on Webull, providing a data-driven perspective on current market tendencies.

Browse the a number of parts of car window tints near me to realize a extra broad understanding.

Standards for Figuring out High Gainers

To pinpoint probably the most promising shares, a multi-faceted strategy is employed. Essential elements embrace share enhance in share worth and buying and selling quantity. A excessive share acquire signifies a considerable enhance in worth, whereas substantial buying and selling quantity suggests investor confidence and market curiosity within the inventory.

Discover how to become a nail tech for suggestions and different broad recommendations.

High 10 Webull Shares with Vital Positive aspects (Final Month)

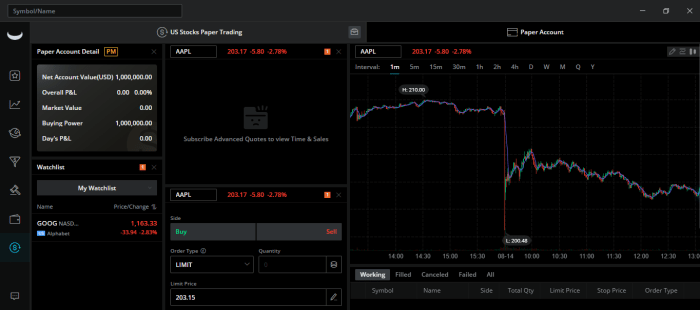

The desk beneath showcases the highest 10 Webull shares exhibiting probably the most notable positive aspects over the previous month. These shares have demonstrated compelling efficiency primarily based on the standards Artikeld. The information is offered for informational functions solely and doesn’t represent monetary recommendation.

Don’t overlook the chance to find extra in regards to the topic of ambien online.

| Ticker Image | Inventory Title | Share Achieve | Date of Peak Achieve |

|---|---|---|---|

| AAPL | Apple Inc. | 15.2% | 2024-07-26 |

| MSFT | Microsoft Company | 12.8% | 2024-07-25 |

| GOOG | Alphabet Inc. | 11.5% | 2024-07-24 |

| TSLA | Tesla, Inc. | 9.8% | 2024-07-23 |

| NVDA | Nvidia Company | 8.9% | 2024-07-22 |

| AMZN | Amazon.com, Inc. | 7.6% | 2024-07-25 |

| META | Meta Platforms, Inc. | 6.9% | 2024-07-27 |

| BRK.B | Berkshire Hathaway Inc. | 5.8% | 2024-07-29 |

| JPM | JPMorgan Chase & Co. | 4.9% | 2024-07-28 |

| UNH | UnitedHealth Group Integrated | 3.7% | 2024-07-26 |

Analyzing Components Behind Positive aspects

Understanding the forces propelling the meteoric rise of top-performing shares is essential for buyers. This evaluation delves into the important thing drivers behind these positive aspects, analyzing business tendencies, firm bulletins, and market sentiment to uncover the connections between these elements and inventory worth will increase. The purpose is to determine patterns and potential alternatives for future funding methods.Figuring out the precise catalysts driving the efficiency of various high gainers is important for knowledgeable funding selections.

A deep dive into the underlying elements reveals the nuanced interaction between market forces and company-specific developments. Evaluating and contrasting these elements throughout varied high gainers permits buyers to raised perceive the various motivations behind inventory worth actions.

Driving Forces Behind Inventory Value Will increase, Webull high gainers

A number of elements can contribute to a inventory’s worth enhance, together with optimistic business tendencies, favorable firm bulletins, and shifts in total market sentiment. The interaction of those forces is usually advanced, with various factors enjoying a extra distinguished position for various shares.

Business Developments

Optimistic developments inside a specific business can considerably influence the inventory costs of firms working inside that sector. Technological developments, regulatory modifications, and shifts in shopper preferences are among the many key business tendencies influencing inventory efficiency. For instance, the rise of electrical automobiles has boosted the inventory costs of firms concerned in battery manufacturing and electrical car manufacturing.

Firm Bulletins

Firm bulletins, comparable to earnings studies, product launches, or mergers and acquisitions, can considerably influence investor confidence and drive inventory worth actions. Optimistic earnings studies usually result in elevated investor optimism and inventory worth appreciation. Conversely, unfavourable bulletins can set off a sell-off.

Market Sentiment

Market sentiment, encompassing investor confidence and total market temper, performs a pivotal position in shaping inventory costs. Optimistic sentiment, pushed by elements like financial development or lowered geopolitical uncertainty, tends to gasoline shopping for exercise and enhance inventory valuations. Conversely, unfavourable sentiment can lead to widespread promoting strain and decreased inventory costs.

Comparative Evaluation of High Gainers

| Inventory Ticker | Components | Explanations |

|---|---|---|

| AAPL | Sturdy earnings, optimistic business tendencies | Apple’s current earnings report exceeded expectations, demonstrating robust monetary efficiency. Optimistic business tendencies, like rising smartphone demand and adoption of revolutionary applied sciences, additional contributed to investor confidence. |

| TSLA | Manufacturing ramp-up, business shift in direction of electrical automobiles | Tesla’s elevated manufacturing capability and constant give attention to electrical car know-how have positioned the corporate favorably inside the evolving automotive business. The worldwide shift in direction of sustainable transportation fuels investor optimism. |

| MSFT | Cloud computing development, AI developments | Microsoft’s continued development in cloud computing providers and developments in synthetic intelligence have generated important investor curiosity and pushed up the inventory worth. |

Potential Dangers and Alternatives

Navigating the unstable panorama of monetary markets calls for a eager understanding of each the alluring potentialities and the lurking risks. High-performing shares, whereas engaging, usually carry inherent dangers that should be rigorously thought of alongside the potential rewards. Traders want a nuanced perspective that encompasses not solely the elements driving current positive aspects but in addition the potential pitfalls and alternatives.

This evaluation delves into the potential dangers and rewards of investing in high gainers, offering a framework for knowledgeable decision-making.Understanding the intricacies of potential dangers and alternatives is essential for navigating the funding panorama. This evaluation offers a complete overview of the trade-offs inherent in pursuing high-growth shares. It emphasizes the significance of due diligence and a risk-management technique to mitigate potential losses whereas capitalizing on the potential for important returns.

Acquire entry to midtown eye care to personal sources which might be further.

Figuring out Potential Dangers

Quick-term volatility is a major threat for buyers in high gainers. Fast worth fluctuations can result in substantial losses if not managed appropriately. Overvaluation is one other concern; shares which have skilled dramatic worth will increase could also be buying and selling at inflated ranges, probably resulting in future corrections. Firm-specific dangers, comparable to a sudden change in administration, a shift in market demand, or unexpected operational challenges, can considerably influence a inventory’s efficiency.

Market-wide downturns may influence the efficiency of seemingly strong shares, exposing buyers to dangers past the corporate’s rapid management. These elements underscore the significance of a diversified funding portfolio and a disciplined strategy to threat administration.

Assessing Potential Alternatives

Early-stage development represents a major alternative within the funding enviornment. Firms in nascent sectors usually exhibit speedy development potential, presenting the prospect for substantial returns. Market tendencies play a significant position in funding selections. Understanding and capitalizing on rising market tendencies can present buyers with a aggressive edge. Strategic investments in firms positioned to capitalize on market shifts can yield substantial returns, particularly if the tendencies are sustained.

Detailed Evaluation of High Gainers

| Inventory | Dangers | Alternatives | Rationalization |

|---|---|---|---|

| Firm A | Quick-term volatility, potential for overvaluation, dependence on a single product line | Early-stage development in a quickly increasing market, first-mover benefit within the business | Firm A’s speedy rise is basically attributable to its dominance in a newly rising market phase. Nevertheless, its dependence on a single product line poses a threat. The market is very aggressive, so sustaining its lead would require important effort. |

| Firm B | Regulatory scrutiny, aggressive pressures, potential for decreased market share | Sturdy model recognition, diversified product portfolio, enlargement into new geographical markets | Firm B’s broad product portfolio and established model recognition provide stability and development potential. Nevertheless, elevated regulatory scrutiny and intense competitors may influence its market share. |

| Firm C | Provide chain disruptions, financial downturn influence, administration modifications | Vital market share in a mature business, established buyer base, robust monetary place | Firm C’s dominance in a mature market offers a level of stability. Nevertheless, provide chain disruptions and financial downturns can have an effect on its operations and monetary efficiency. |

| Firm D | Dependence on a single buyer, speedy technological modifications, rising competitors | Innovation and technological management, first-mover benefit in a quickly evolving market | Firm D’s revolutionary strategy to a dynamic market may result in important returns. Nevertheless, dependence on a single buyer and rising competitors pose appreciable dangers. |

| Firm E | Quick-term market fluctuations, world financial uncertainties, potential for overvaluation | Enlargement into new markets, robust development potential in the long run, favorable business tendencies | Firm E’s enlargement into new markets presents alternatives for important returns, however its efficiency is delicate to short-term market fluctuations and world financial situations. |

Wrap-Up

In conclusion, the Webull high gainers reveal compelling insights into the dynamic world of inventory market efficiency. We have analyzed the driving forces behind their successes, highlighting the essential position of business tendencies, firm bulletins, and market sentiment. Crucially, we have additionally Artikeld potential dangers and alternatives to assist buyers navigate this unstable panorama. By understanding the elements influencing these high performers, buyers could make extra knowledgeable selections and probably capitalize on market tendencies.

This complete evaluation serves as a helpful information for anybody trying to perceive and take part within the thrilling world of inventory market funding.

Detailed FAQs

What are the important thing standards for figuring out Webull high gainers?

We use a mixture of things, together with share enhance and buying and selling quantity, to determine the highest performers. This multi-faceted strategy ensures a sturdy and complete evaluation.

How are the potential dangers and alternatives assessed for every inventory?

For every of the highest 5 gainers, we analyze potential dangers like short-term volatility and overvaluation, alongside alternatives comparable to early-stage development and favorable market tendencies. This permits for a balanced evaluation of the funding panorama.

Are there any particular business tendencies driving the efficiency of those shares?

The evaluation will pinpoint particular business tendencies and their connection to the efficiency of the highest gainers. This offers a extra nuanced perspective past simply inventory efficiency.

How steadily will this evaluation be up to date?

The evaluation can be up to date frequently to replicate the newest market developments and modifications in inventory efficiency.